Have you ever wondered about the transformative potential of decentralized finance, commonly known as DeFi? In a rapidly evolving financial landscape, DeFi is positioned as a revolutionary force, reshaping the way you think about finance, investments, and cryptocurrencies.

Understanding Decentralized Finance (DeFi)

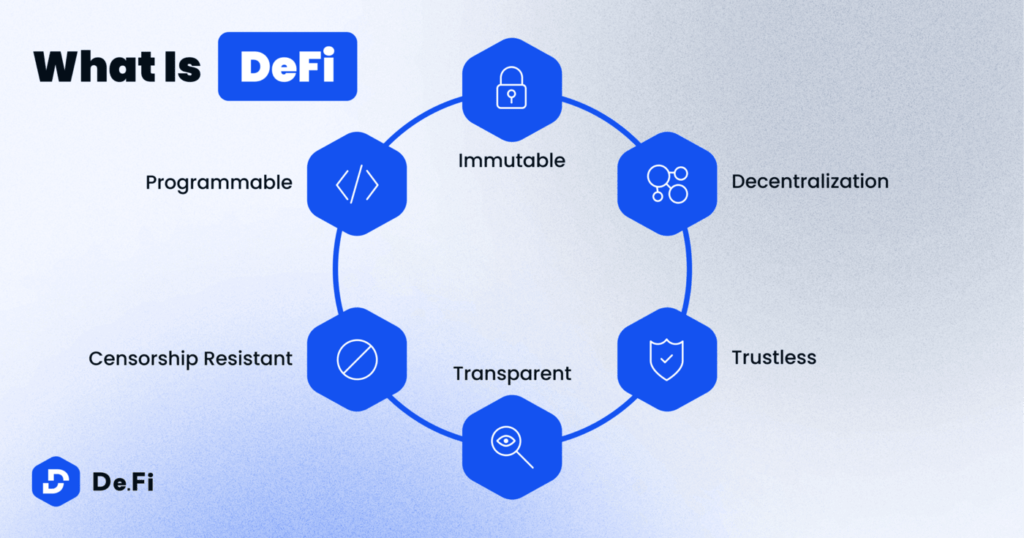

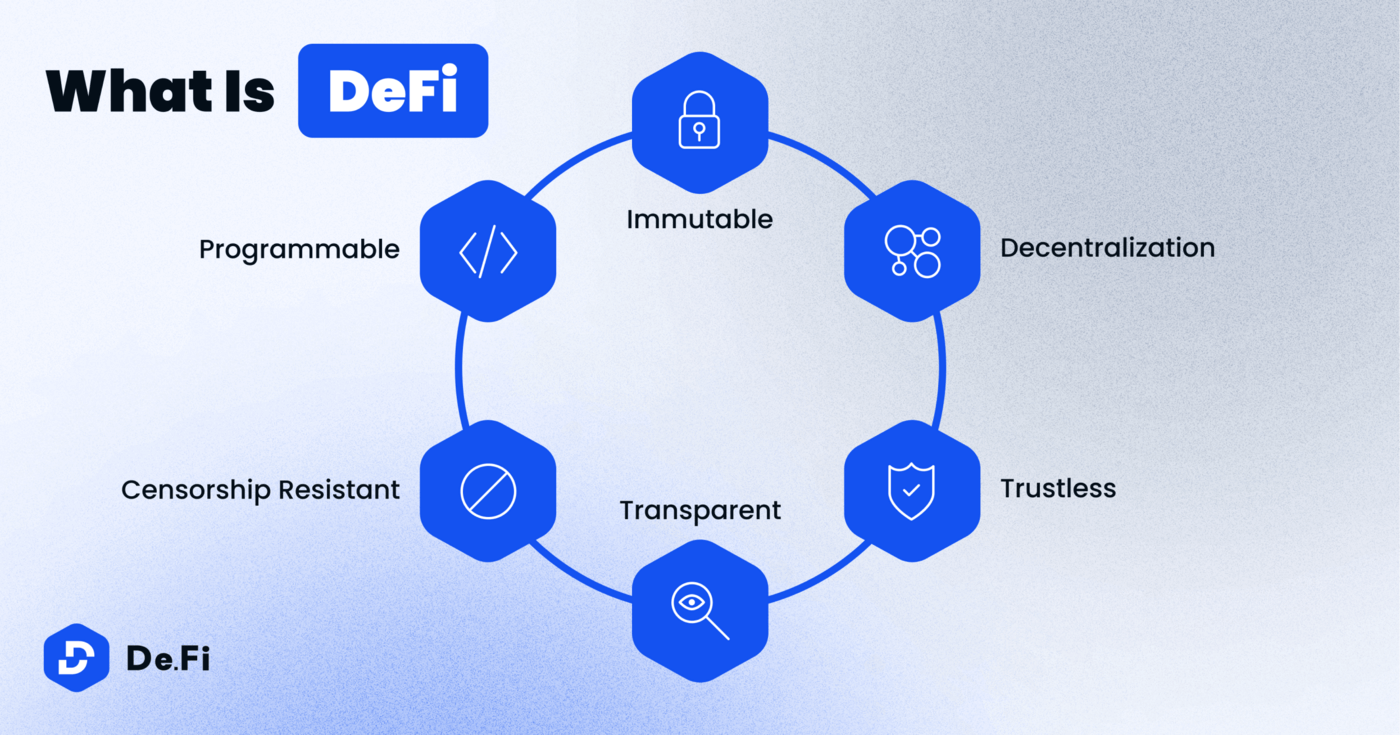

Decentralized Finance, or DeFi, represents a significant shift in the traditional financial paradigm. As opposed to centralized financial systems, DeFi operates on decentralized blockchain networks, which allow for smart contracts to execute automatically. By eliminating the need for intermediaries such as banks and brokerage firms, DeFi provides greater accessibility, transparency, and versatility in financial transactions.

Key Concepts of DeFi

To understand DeFi, it’s essential to grasp its foundational concepts, which form the basis of its functionality and appeal.

Blockchain Technology

Blockchain technology is the underlying infrastructure that supports DeFi. It is a distributed ledger that records all transactions across a network of computers. This technology ensures data integrity, transparency, and security, making it ideal for financial transactions that require trust and security.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These digital contracts automatically execute procedures once predetermined conditions are met, significantly reducing the need for manual intervention and promoting efficiency and accuracy within the DeFi ecosystem.

Tokens and Cryptocurrencies

In the DeFi environment, various tokens exist, each serving different purposes. Native tokens of specific blockchains (such as Ethereum’s ETH), utility tokens, security tokens, and stablecoins all play significant roles in facilitating transactions, securing networks, and providing liquidity.

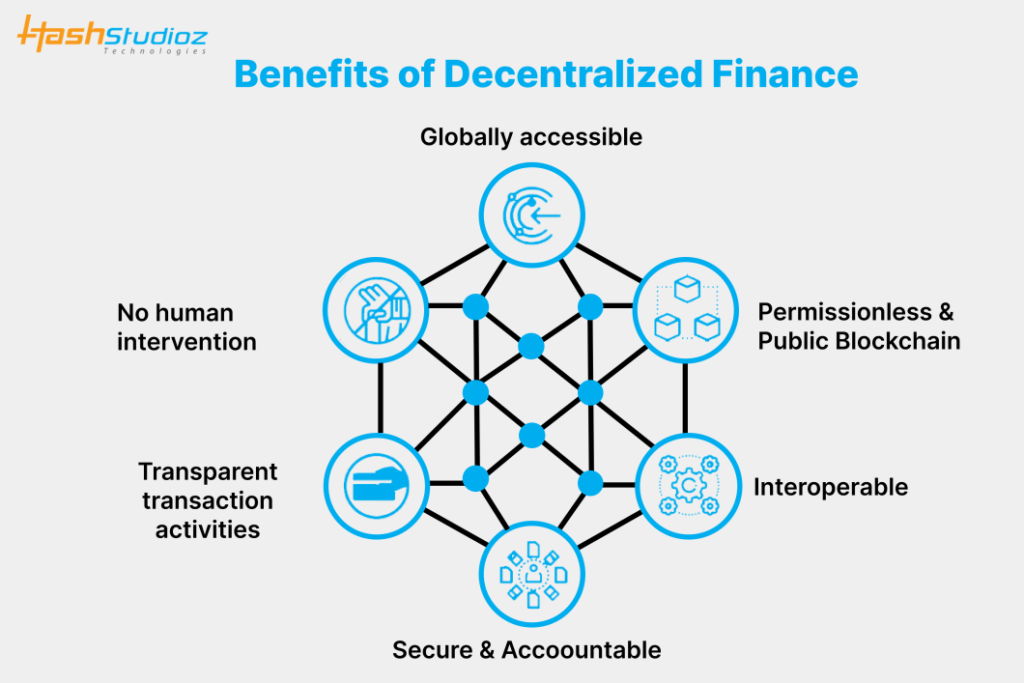

The Core Benefits of DeFi

DeFi provides numerous benefits over traditional financial systems. Understanding these advantages is crucial for realizing why DeFi is gaining traction.

-

Accessibility: DeFi platforms are accessible to anyone with an internet connection, removing barriers present in traditional banking, like geographical location or credit scoring.

-

Transparency: All transactions are recorded on public ledgers. This transparency ensures accountability and fosters trust within the DeFi community.

-

Immutability: Once recorded on the blockchain, transactions cannot be altered, offering security against fraud and manipulation.

-

Interoperability: DeFi projects often can work seamlessly with one another, thanks to open-source and modular frameworks, fostering innovation and synergies.

-

Innovation: DeFi enables the rapid creation of new financial products and services, empowering users with cutting-edge tools and opportunities.

How DeFi Impacts the Crypto Landscape

DeFi’s influence on the cryptocurrency market is profound. It not only enhances the utility of cryptocurrencies but also provides new avenues for financial innovation and participation.

Expanding Use Cases for Cryptocurrencies

With DeFi, cryptocurrencies have transcended their initial roles as just investment assets or speculative instruments. They now play integral roles in financial functions such as lending, borrowing, and insurance.

Lending and Borrowing

DeFi platforms like Aave and Compound allow users to lend their cryptocurrencies for interest or borrow against crypto collateral. This mechanism operates without needing credit scores, offering financial services to the unbanked and underbanked populations.

Decentralized Exchanges (DEXs)

Platforms such as Uniswap, Sushiswap, and Balancer allow users to trade cryptocurrencies directly with one another without intermediaries. This peer-to-peer approach reduces costs, enhances privacy, and provides liquidity.

The Role of Stablecoins

Stablecoins, such as USDC and DAI, play a critical role in DeFi by providing a way to engage with cryptocurrencies without exposure to high volatility. They are pegged to fiat currencies, offering stability and reassurance while conducting transactions or storing value within DeFi ecosystems.

Risks and Challenges of DeFi

As transformative as DeFi can be, it also presents a set of risks and challenges that require careful consideration.

Security Vulnerabilities

Smart contracts, while efficient, are not infallible. Vulnerabilities in the code can be exploited by malicious actors, leading to significant financial losses. Regular audits and vigilant monitoring are essential to mitigate these risks.

Regulatory Concerns

DeFi operates in a regulatory gray area, posing challenges for compliance and unforeseen legal implications. Regulatory bodies worldwide are actively exploring frameworks to better govern these decentralized systems.

Market Volatility

The cryptocurrency market, including DeFi assets, is known for its volatility. Price swings can impact users’ wealth, highlighting the need for sound financial strategies and risk management.

Operational Challenges

While DeFi offers numerous advantages, it can also be complex and daunting, particularly for newcomers unfamiliar with technological intricacies. Improved user interfaces and educational resources are essential to broaden participation.

The Future of DeFi

The trajectory of DeFi suggests continued growth and innovation, significantly affecting both personal finance and the broader financial ecosystem.

Integration with Traditional Finance

As DeFi continues to mature, greater integration with traditional financial systems seems inevitable. Banks and traditional financial institutions may adopt DeFi-inspired models, aiming to improve efficiency and customer experience.

Enhanced Financial Inclusion

DeFi holds the potential to empower individuals in regions underserved by traditional banking, offering them opportunities to save, invest, and transact in a globally connected economy.

Sustainable Development and Green Finance

Innovations within DeFi could also facilitate sustainable development and green finance initiatives, supporting projects that emphasize environmental, social, and governance (ESG) criteria.

Conclusion

Decentralized finance, at its core, reimagines financial systems, promising a more inclusive, transparent, and efficient future. While challenges remain, the potential benefits of DeFi underscore its growing importance in the financial world, making it a compelling sector to watch for both individuals and institutions alike. As you navigate the world of DeFi, understanding its fundamentals and implications on the crypto landscape will be crucial in leveraging its full potential.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  USDC

USDC  Lido Staked Ether

Lido Staked Ether