In the dynamic world of cryptocurrencies, navigating the waves of opportunities requires an understanding of key terms and processes that drive the crypto market. Among these, the methods of fundraising play a pivotal role in launching new projects and driving innovation. This guide will introduce you to the core fundraising strategies used in the crypto space.

ICO (Initial Coin Offering), STO (Security Token Offering), IEO (Initial Exchange Offering), and IDO (Initial DEX Offering). By understanding the differences and unique aspects of each, you can better position yourself in this exciting financial frontier and possibly uncover the next big crypto opportunity. Let’s explore these key concepts together!

Table of Contents

ICO (Initial Coin Offering):

This is the cryptocurrency equivalent of an Initial Public Offering (IPO). A company looking to raise money to create a new coin, app, or service launches an ICO as a way to raise funds. In an ICO, interested investors buy the offering company’s cryptocurrency (tokens) with fiat money or existing digital currencies. These tokens typically carry future benefits for holders when the project launches.

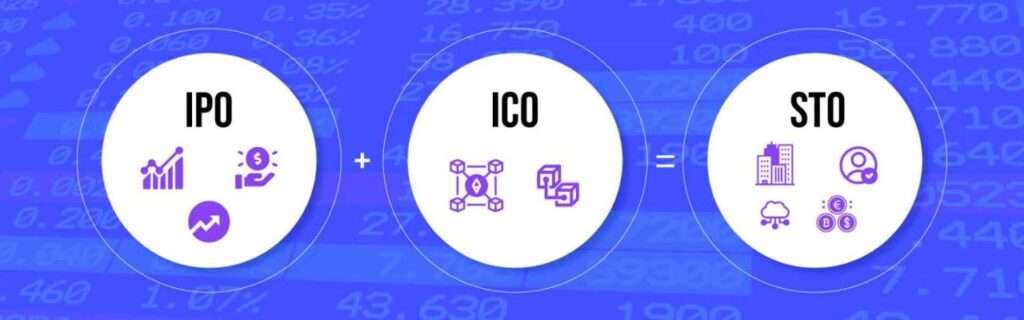

STO (Security Token Offering):

Similar to an ICO, an STO represents the launch of a cryptocurrency token, but these tokens are backed by an underlying asset or company profits, similar to traditional securities. STOs are subject to securities regulations, making them a safer and more secure investment option, as they have to comply with relevant legal and financial frameworks.

IEO (Initial Exchange Offering):

This is a variant of an ICO, but it’s conducted directly on a cryptocurrency exchange platform. The token issuer provides the tokens to the exchange, which then sells the tokens to individual investors. This method allows investors to bypass some of the risks associated with ICOs, as exchanges conduct their due diligence on the token issuers.

IDO (Initial DEX Offering):

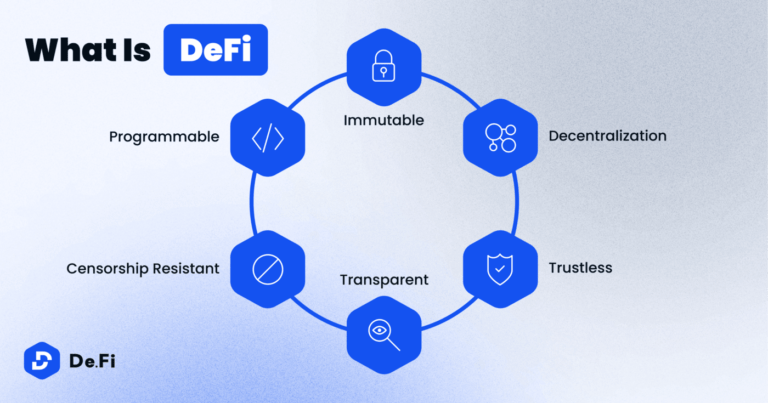

IDO is a token offering that takes place on a decentralized exchange (DEX). Unlike traditional exchanges, DEXs are run by smart contracts, ensuring full decentralization, and users retain full control over their funds. In an IDO, the token is listed on a DEX, and the public can buy the token directly on the DEX platform. As with other types of offerings, it allows a crypto project to raise funds.

Differences:

The main difference between these offerings lies in the regulation, decentralization level, and method of offering.

- ICO: The earliest form of fundraising in the crypto space. It is less regulated and thus poses a higher risk.

- STO: More regulated than ICOs, they offer securities tokens that pay dividends, share profits, pay interest or invest in other tokens or assets to generate profits for the token holders.

- IEO: An advancement on the ICO model, offering a degree of trust as the exchange vets every project that seeks to launch an IEO on its platform.

- IDO: A new fundraising model that takes place on a decentralized exchange. It offers immediate liquidity and full decentralization but with less regulatory oversight.

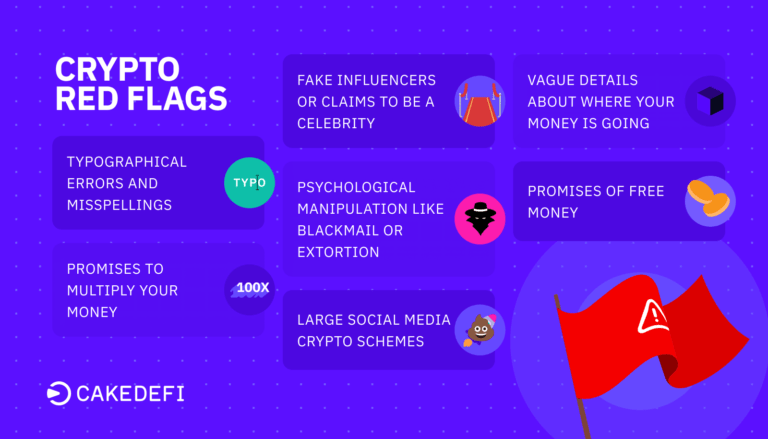

As always, while these offerings have revolutionized fundraising, they also come with risks. Potential investors should thoroughly research and consider these risks before participating in ICOs, STOs, IEOs, or IDOs.

Also Read this Blog: Master Trading: Top Crypto Trading Strategies for Beginners 2023

ICO vs. IDO – Which is the Right Choice for Your Project?

Choosing between an Initial Coin Offering (ICO) and an Initial DEX Offering (IDO) for your project largely depends on various factors, including the nature of your project, the regulatory environment, and the level of decentralization you aim to achieve. Let’s break down the key aspects of each method to help you make an informed decision:

ICO (Initial Coin Offering):

- Control: ICOs offer more control over the fundraising process, as you can directly interface with your investors. You can set your terms, including the price per token, minimum or maximum investment caps, and the duration of the offering.

- Regulation: ICOs are less regulated, which can be a double-edged sword. On one hand, it provides more freedom to operate. On the other hand, less regulation can deter some investors due to potential legal risks and scams associated with ICOs.

- Audience Reach: Depending on your marketing strategies, you can potentially reach a wider audience. However, converting that reach into an investment can be a challenge due to trust issues.

- Trust Factor: Trust plays a crucial role in ICOs. Since they are not directly regulated, potential investors have to trust that your project is legitimate and that you will deliver on your promises.

IDO (Initial DEX Offering):

- Decentralization: IDOs are more decentralized as they are conducted on decentralized exchanges (DEXs). This attracts investors who favor complete decentralization and are comfortable using DEXs.

- Immediate Liquidity: IDOs provide immediate liquidity because the tokens are listed on the DEX right away. Investors can buy and sell the tokens as soon as the IDO is live.

- Lower Fees: Generally, conducting an IDO can be cheaper than an ICO because you’re not required to invest heavily in marketing campaigns or roadshows to attract investors.

- Credibility: While not foolproof, projects that go through an IDO tend to be perceived as more credible since most DEX platforms conduct their own due diligence before listing a project.

Diving into Case Studies: An In-depth Look at Successful Cryptocurrency Fundraisers

To shed light on the practical application of the concepts we’ve discussed, it’s beneficial to analyze real-life examples of effective cryptocurrency fundraisers. By doing so, we can understand how the principles of ICO, STO, IEO, and IDO apply in the actual world of cryptocurrencies.

The Trailblazer ICO – Ethereum (ETH):

One of the most successful examples of an Initial Coin Offering (ICO) in the cryptocurrency realm is Ethereum, which launched its ICO back in 2014. Ethereum succeeded in selling 60 million Ether tokens at a rate of 0.0005 Bitcoin per token. The result was an astounding collection of 31,500 Bitcoins, equivalent to approximately $18.5 million at that time.

But what truly sets Ethereum apart is its groundbreaking innovation – the introduction of smart contract functionality. By doing so, it not only revolutionized blockchain applications but also paved the way for other fundraising methods to come into existence, namely ICOs, STOs, IEOs, and IDOs.

The Secure STO – tZERO:

tZERO, an offshoot of Overstock, stands as a testament to the success potential of Security Token Offerings (STOs). In August 2018, the project managed to raise a significant $134 million, demonstrating the STO’s prowess as a fundraising method.

What makes tZERO’s tokens distinct is their representation as actual securities. As a result, token holders find themselves entitled to a portion of the company’s profits, thereby making the STO a more secure investment option compared to its counterparts.

The Innovative IEO – Matic Network (Polygon):

Matic Network, which has since rebranded as Polygon, is a shining example of a successful Initial Exchange Offering (IEO). Polygon carried out its IEO on the esteemed Binance Launchpad platform in April 2019, raising a total of $5 million.

Polygon’s effective use of the IEO model has propelled it to become a significant player in the field of blockchain scalability and interoperability, further endorsing the effectiveness of IEOs.

The Decentralized IDO – Uniswap (UNI):

Uniswap, a decentralized trading protocol, chose the route of an Initial DEX Offering (IDO) to launch its token, UNI, in September 2020. Thanks to the IDO model, UNI was immediately available for trading, providing instant liquidity for investors.

The IDO proved to be a considerable success, with UNI swiftly ascending the ranks to become one of the top tokens in the burgeoning Decentralized Finance (DeFi) space.

In conclusion, these case studies serve as real-world proof of how ICOs, STOs, IEOs, and IDOs can be effectively utilized for fundraising in the cryptocurrency domain. Each method carries its own set of strengths and is tailored to suit different project requirements, thus offering a range of options for future crypto endeavors.

So, Which is the Right Choice for Your Project?

The answer to this question primarily depends on your project’s specific needs and circumstances:

- If you prefer a more regulated, centralized, and control-over-the-process approach, and are ready to invest in extensive marketing to build trust, then an ICO might be a suitable choice for your project.

- However, if you favor a more decentralized approach, want immediate liquidity, and aim to save on the costs associated with the fundraising process, then an IDO could be a better option for your project.

Remember, each method comes with its own set of pros and cons, and potential legal implications. It’s recommended to consult with a legal advisor familiar with crypto regulations in your target jurisdictions before deciding.

Wrapping up:

As we conclude our exploration of ICOs, STOs, IEOs, and IDOs, it’s essential to remember that while these fundraising methods can offer significant opportunities, they also come with their own set of risks. Due diligence is crucial in this highly volatile space. Make sure you thoroughly research and understand any project before investing.

Armed with knowledge and a clear understanding of these fundraising strategies, you’re now better prepared to navigate the diverse and ever-evolving cryptocurrency landscape. Remember, in the world of crypto, learning never stops. Keep exploring, stay curious, and may your crypto journey be filled with success and growth!

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  USDC

USDC  Lido Staked Ether

Lido Staked Ether