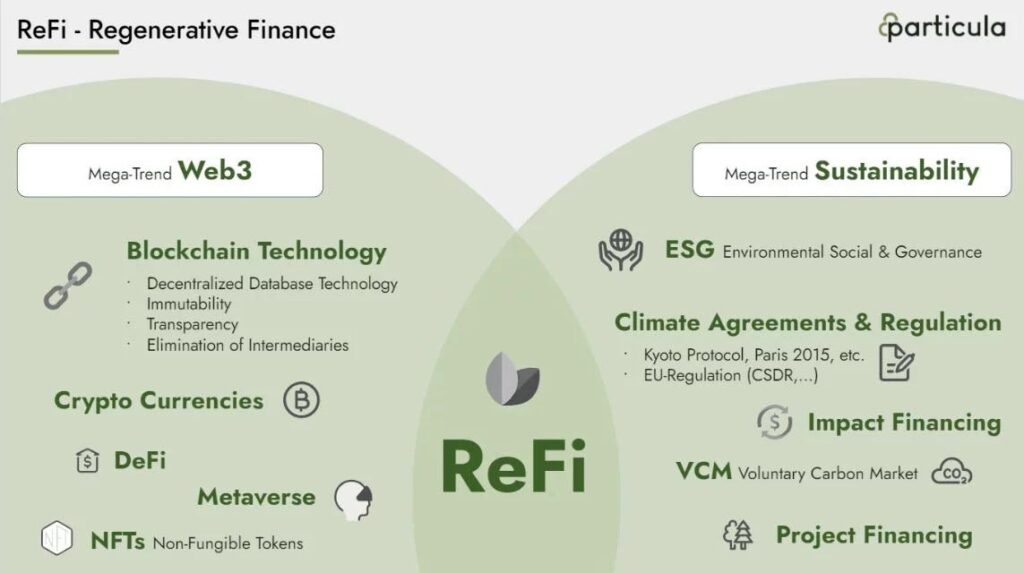

What if you could participate in a financial system that not only benefits you but also contributes positively to the environment and society? This intriguing question positions you at the heart of a revolutionary concept in the world of finance—Regenerative Finance (ReFi). As traditional financial systems face scrutiny for their environmental impact, emerging trends in cryptocurrency are challenging the status quo. ReFi represents a paradigm shift that integrates the principles of sustainability with the opportunities presented by decentralized finance (DeFi).

Understanding Regenerative Finance (ReFi)

Regenerative Finance (ReFi) is a fledgling concept situated at the intersection of finance, technology, and sustainability. By harnessing the power of blockchain, ReFi seeks to create financial systems that regenerate rather than deplete natural and social ecosystems. This innovation asserts that financial markets can be structured to contribute to ecological balance and social equity, making them both financially lucrative and ethically sound.

The Core Principles of ReFi

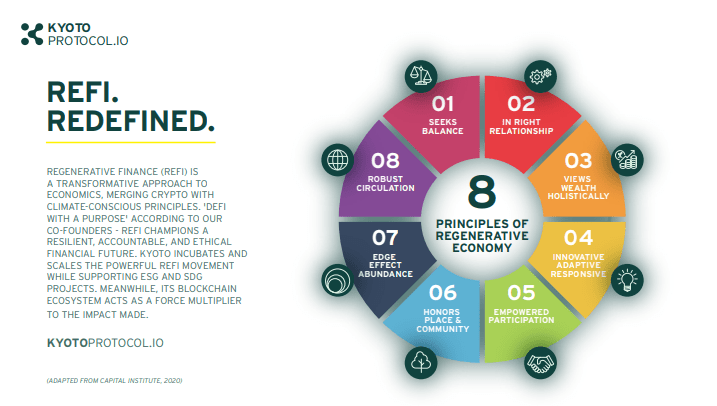

ReFi is built on several foundational principles that differentiate it from traditional financial systems:

-

Sustainability: At its core, ReFi prioritizes sustainability. Investments are directed toward projects that offer long-term ecological and social benefits rather than short-term profits.

-

Equity: A key tenet of ReFi is fairness. This approach aims to democratize financial opportunities, ensuring that underserved communities have access to the same resources and benefits as traditional investors.

-

Transparency: Utilizing blockchain technology, ReFi promotes transparency in financial transactions. This openness helps to build trust among stakeholders and allows for better tracking of the impact of investments.

-

Resilience: ReFi emphasizes resilience by investing in projects that can withstand environmental and economic challenges. This principle ensures that both ecosystems and communities can thrive in the face of adversity.

The Role of Blockchain in ReFi

Blockchain technology is crucial to the development and implementation of ReFi. Through decentralized ledgers and smart contracts, blockchain facilitates transparent, secure, and efficient transactions. Here’s how blockchain contributes to ReFi:

Enhanced Transparency and Accountability

By recording all transactions on a public ledger, blockchain ensures that all stakeholders can see how funds are being utilized. This traceability builds trust, allowing investors to verify that their funds are genuinely contributing to sustainable projects.

Efficient Financial Transactions

Blockchain automates the process of transactions through smart contracts, which execute predefined agreements when specific conditions are met. This efficiency reduces the need for intermediaries, lowering costs and speeding up funding processes for sustainable initiatives.

Tokenization of Assets

ReFi leverages the concept of tokenization, allowing for fractional ownership of assets. This innovation enables a broader range of individuals to invest in sustainable projects that they may not have been able to afford otherwise. Tokenization democratizes access to investment opportunities, promoting inclusivity.

Applications of Regenerative Finance

ReFi finds application in various sectors, all aimed at promoting sustainability and social equity. Some of these applications will be examined below:

Renewable Energy Financing

Regenerative Finance plays a vital role in facilitating investments in renewable energy projects. By offering decentralized financing options, ReFi enables individuals and organizations to invest in solar, wind, and other renewable initiatives.

- Example: Platforms like SolarCoin create a mechanism to reward solar energy producers with a digital currency, incentivizing the adoption of solar technologies.

Sustainable Agriculture

ReFi fosters investments in sustainable agriculture practices. Tokenized assets can help farmers access funding for eco-friendly technologies, improving yield while reducing their environmental footprint.

- Example: Blockchain platforms that track the supply chain can help consumers verify that their food is sourced sustainably and ethically.

Carbon Credit Trading

By leveraging blockchain’s transparency, ReFi can create efficient markets for carbon credits. This allows businesses to buy and sell carbon credits easily, encouraging companies to lower their emissions.

- Example: Platforms like Toucan Protocol enable users to tokenize carbon credits, creating a more dynamic ecosystem for trading and reducing carbon footprints.

The Challenges Facing ReFi

Despite its promise, Regenerative Finance faces several challenges that need addressing to fulfill its potential. These range from technical hurdles to regulatory barriers.

Technology and Scalability Issues

While blockchain technology offers transparency and efficiency, it is not without its challenges. Cryptocurrency platforms can experience scalability issues, leading to slower transaction times and higher costs during peak usage. Ensuring that ReFi platforms can handle increased demand while maintaining low fees will be crucial to their success.

Regulatory Uncertainty

As an emerging field, ReFi operates in a loosely defined regulatory environment. Governments worldwide are still examining how cryptocurrencies and blockchain technology should be regulated. This lack of clarity can hinder investment and inhibit growth in the sector.

Public Awareness and Education

For ReFi to gain traction, greater public awareness and understanding of its benefits are necessary. Many potential investors may be unaware of how ReFi operates or how it can contribute to a more sustainable future. Educating the public can help to promote adoption and encourage participation from diverse stakeholders.

The Future of Regenerative Finance

As you look ahead, the potential for Regenerative Finance appears promising. With increasing concerns regarding climate change and social inequality, the need for innovative financial solutions that address these issues becomes more urgent.

Growing Interest from Investors

More investors are recognizing the intrinsic value of aligning financial returns with sustainable impact. As awareness of ReFi grows, it is likely that you will see a surge in investment directed toward environmentally friendly projects.

Innovation and Collaboration

The ReFi ecosystem is characterized by a spirit of collaboration among various stakeholders, including startups, NGOs, and established financial institutions. This collective effort can foster the creation of innovative financial products and services tailored to sustainable development goals.

Integration with Traditional Finance

Over time, traditional financial institutions may begin to integrate ReFi principles into their operations, thereby promoting a more holistic approach to finance. This hybrid model can facilitate a transition toward a more sustainable and equitable financial system.

Conclusion

You stand at the precipice of a financial revolution with Regenerative Finance. This emerging trend intertwines the worlds of cryptocurrency and sustainability, offering the promise of a more equitable and environmentally conscious financial landscape. As the principles of ReFi gain traction, they hold the potential to reshape traditional finance and inspire a new generation of investors to consider not just profits, but also the broader impact of their financial decisions.

By embracing the tenets of sustainability, equity, transparency, and resilience, ReFi invites you to redefine what it means to invest wisely. Seeking out opportunities within this evolving ecosystem allows you to contribute positively to society and the environment while still achieving financial growth. Ultimately, Regenerative Finance represents a path toward a future where finance serves as a force for good, unlocking a world of possibilities that benefit both you and the planet.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  USDC

USDC  Lido Staked Ether

Lido Staked Ether