How sure are you that your cryptocurrency investments are secure from scams? As appealing as the cryptocurrency market is, it has also become a breeding ground for fraudsters and malicious schemes. Knowing the tell-tale signs of crypto scams can mean the difference between securing your investment or falling victim to financial loss. In this professional guide, we will explore the red flags every investor should know to avoid these schemes.

Understanding the Crypto Landscape

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central bank and leverages blockchain technology, which is essentially a distributed ledger that records all transactions across a network. While the innovation in blockchain offers promising opportunities, the pseudo-anonymity of crypto transactions makes it an attractive target for scams and fraudulent activities.

The Growth of Cryptocurrency

The rise in the popularity of cryptocurrencies has led to an exponential increase in their trading volumes. With millions of people worldwide investing in various forms of digital currencies like Bitcoin, Ethereum, and others, the crypto market has developed into a thriving industry. Unfortunately, this rapid expansion has also attracted individuals with malicious intent, resulting in a significant rise in crypto-related scams.

Why Crypto is an Attractive Target for Scams

Several factors contribute to digital currencies being a prime target for swindlers. Firstly, the lack of comprehensive regulation creates a gray area where scammers can operate with little fear of legal repercussions. Secondly, the complex nature of blockchain technology and digital wallets can confuse newcomers, making them susceptible to deception. Lastly, the irreversible nature of crypto transactions means that once funds are transferred, they cannot be recovered, making it critical for investors to identify potential scams.

Types of Crypto Scams

Before diving into specific red flags, understanding the common types of crypto scams is essential. By being aware of the various forms these scams can take, you can better protect your investments.

Phishing Scams

Phishing involves fraudulent parties impersonating legitimate entities to trick you into revealing personal information or financial details. This can come in various forms, such as emails, fake websites, or even SMS messages designed to capture sensitive information or lead you to a bogus website.

Ponzi Schemes

Cryptocurrency Ponzi schemes lure investors with promises of high returns with minimal risk. As new investors join, their capital is used to pay returns to earlier investors, creating a facade of profitability. Eventually, the scheme collapses when the flow of new investors cannot sustain payouts.

Pump and Dump Schemes

Pump and dump schemes involve artificially inflating the price of a cryptocurrency through misleading and flamboyant statements. Once the price has surged due to heightened investor interest, the scammers sell off their overvalued shares for a profit, leading to a sharp decline in the value of the crypto.

Fake ICOs

Initial Coin Offerings (ICOs) are a popular way for startups to raise capital. Scammers take advantage of this by creating fake ICOs, soliciting investments from unsuspecting investors, and then disappearing with the funds.

Malware Attacks

By deploying malware, scammers can gain access to your cryptocurrency wallet and transfer your funds without your consent. Such malware can be unwittingly downloaded through suspicious links or attachments.

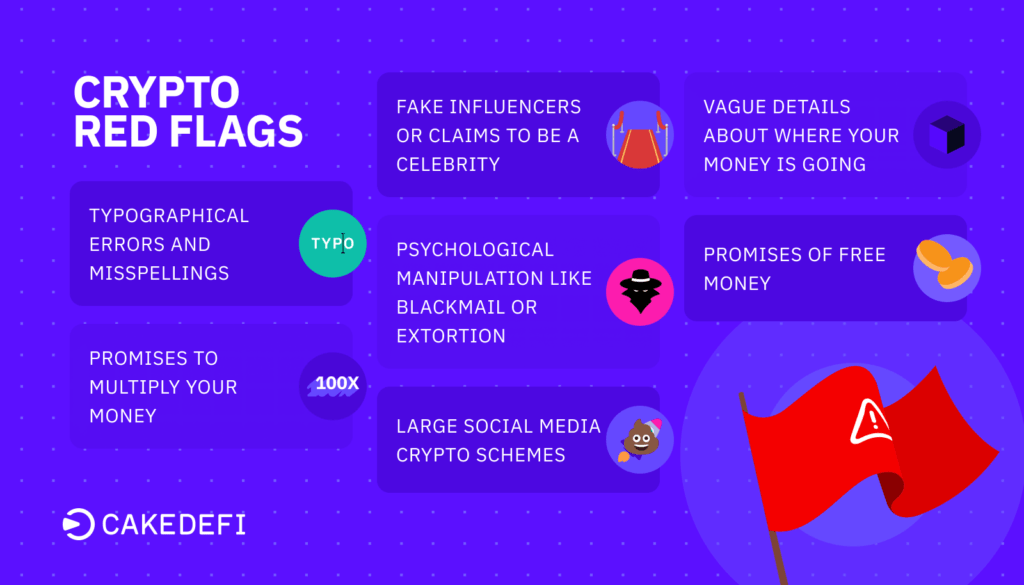

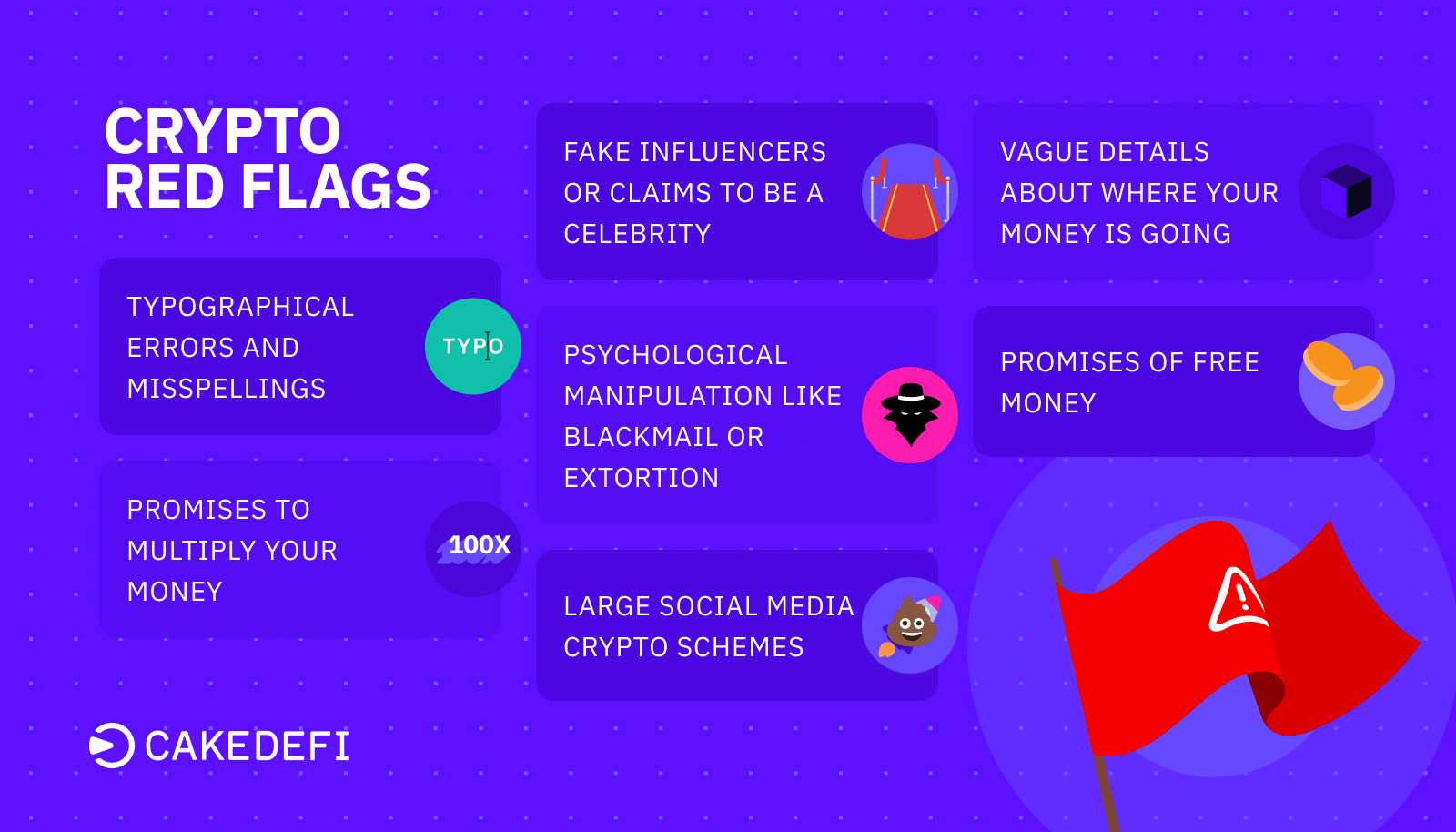

Recognizing Red Flags in Crypto Investments

Arming yourself with knowledge about crypto scams is key to safeguarding your financial future. Here, we will discuss the red flags you should look for when investing in cryptocurrencies.

Unrealistic Returns

If an investment opportunity promises returns that seem too good to be true, they usually are. Legitimate investments always carry some level of risk, and any claim of large, guaranteed returns should raise your suspicion.

Pressure to Invest Quickly

Scammers often create a sense of urgency to prevent you from taking the time to research and validate an investment opportunity. Be wary of any investment that pressures you to act immediately without providing ample information for due diligence.

Lack of Transparency

A legitimate cryptocurrency project will offer transparency in its operations, team, and future plans. If an investment opportunity is vague about these details, or if the information provided is inconsistent, it should be a red flag.

Poorly Written White Papers

A white paper is a crucial document that outlines the technical and business details of a crypto project. A poorly written or plagiarized white paper is a clear indication of an illegitimate investment.

Anonymous or Unverifiable Teams

While cryptocurrency projects value privacy, knowing the team behind an investment is critical. If the team members’ identities are hidden or their backgrounds unverifiable, this could indicate a scam.

Unregistered Securities

Verify whether the investment offering is registered with financial regulatory bodies such as the SEC (Securities and Exchange Commission) in the United States. Unregistered securities pose a substantial risk as they often operate outside the legal framework established to protect investors.

High Number of Social Media Promotions

Just because a project is heavily promoted on social media doesn’t mean it’s legitimate. Be cautious of investments that rely heavily on social media marketing as scammers often exploit these platforms to reach a broader audience.

Email or Website Anomalies

Pay attention to details in emails and websites, such as incorrect domain names, spelling errors, or poor website design. Scammers create sites that mimic legitimate businesses but often miss subtle details, which can serve as warning signs.

How to Conduct Due Diligence

Performing due diligence is essential to making informed investment decisions. Here are steps you can take to verify the legitimacy of a cryptocurrency project.

Verify the Legitimacy of the Project

-

Research the Project: Look into the project’s goals, applications, and proposed solutions. Assess whether the project has a clear vision and a feasible plan for execution.

-

Check Team Credentials: Research the team members behind the project. Verify their identities and review their professional backgrounds through platforms such as LinkedIn.

-

Review the White Paper: Analyze the project’s white paper for clarity and details. Ensure it outlines the technical specifications, purpose, and strategy of the cryptocurrency.

Analyze the Market Standing

-

Evaluate the Community: Genuine projects often have an active and engaged community. Participate in discussions and forums to gauge community sentiment.

-

Scrutinize the Roadmap: Examine the project’s roadmap to see if goals and timelines are realistic. Determine if previous milestones were achieved as per the specified timeline.

-

Stay Informed: Keep updated with news and analyses from credible crypto investors and analysts. Reliable sources can provide insights that are not easily discernible from the project descriptions alone.

Utilize Online Tools

-

Block Explorers: Use block explorers to track transactions and verify the quantity and flow of crypto funds, ensuring the project’s claims align with blockchain data.

-

Smart Contract Audits: Seek out audit reports of the project’s smart contracts from reputable blockchain audit firms. This can confirm the absence of vulnerabilities and align the project’s code with its claims.

-

Regulatory Status: Check with financial regulatory bodies to ensure the cryptocurrency complies with local regulations.

Protecting Your Crypto Investments

Defense is the best offense when it comes to protecting your investments. Implementing best practices reduces the likelihood of becoming a scam victim.

Secure Your Digital Wallets

-

Use Hardware Wallets: Store your cryptocurrencies in hardware wallets where possible. They are offline and provide an extra layer of security.

-

Enable Two-Factor Authentication (2FA): Apply 2FA to your crypto accounts to thwart unauthorized attempts to access them.

-

Regular Software Updates: Keep your wallet software updated to include the latest security patches.

Implement Strong Security Practices

-

Use Strong Passwords: Create complex, unique passwords for your cryptocurrency accounts and change them regularly.

-

Avoid Public Wi-Fi: Public networks are vulnerable to hacking attempts. When trading or checking your investments, use a private and secure internet connection.

-

Be Skeptical of Unknown Contacts: Exercise caution when dealing with unsolicited messages or contacts that request private information or suggest investment opportunities.

Keep a Backup

Always have a backup of your wallet’s recovery phrase and private keys. Consider using secure methods, such as encrypted storage, to protect this information.

Reporting and Recovery

In the unfortunate event you fall victim to a scam, knowing the steps to report and attempt recovery is crucial.

Identifying the Scam

Firstly, gather detailed information about the scam, such as transaction details, emails, or website copies. The more evidence you have, the better chances authorities have to investigate and take action.

Reporting the Incident

Contact local law enforcement and financial regulatory bodies with your collected evidence. Reporting the crime not only supports your chance of recovery but also aids in helping others avoid similar predicaments.

Informing the Crypto Community

Notify the cryptocurrency exchange where you conducted the transaction and engage with social media and crypto forums to warn others about the scam, potentially preventing further victims.

Staying Informed and Vigilant

The ever-evolving landscape of cryptocurrency necessitates constant vigilance and informed decision-making. Staying up-to-date with the latest crypto news and scams ensures you remain an educated investor.

Engaging with Trusted Networks

Join reputable online crypto communities and networks to stay informed and develop a reliable support system. Being part of these networks will provide insights and alerts to ongoing scams and best practices for crypto investment.

Continuous Education

Regularly engage with educational resources such as books, webinars, and courses that cover the nuances of the crypto market. Enhancing your knowledge will improve your risk assessment abilities.

Conclusion

The allure of cryptocurrency investment comes with its share of risks and potential pitfalls. By discerning the red flags and employing robust security practices, you can protect yourself against scams and create a safe environment for your financial ventures. Remaining cautious, informed, and proactive is crucial for safeguarding your crypto investments in an advancing digital world.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  USDC

USDC  Lido Staked Ether

Lido Staked Ether