Bitcoin: The New World Reserve Currency

Table of Contents

Can you hear that? It’s the sound of change – a paradigm shift in our global financial landscape. You see, something monumental has happened, something that has got central banks sweating and financial analysts raving – Bitcoin Replaces USD as the world reserve currency.

Reserve Currency 101

Alright, let’s imagine for a moment. Picture yourself as a country, an entire nation – a fun mental exercise, isn’t it? Now, this country of yours – let’s call it Imaginaria – participates actively in international trade.

From electronics and coffee to software services and the latest eco-friendly vehicles, Imaginaria is buying and selling all sorts of goods and services across the globe.

But here’s the tricky part: When Imaginaria trades with other nations, it can’t always use its local currency, the Imaginari. Why? Well, frankly, other countries might not value it that much.

They’d have to exchange the Imaginari into their currency, which comes with its own set of challenges such as fluctuating exchange rates and transaction fees.

So, what’s Imaginaria’s solution? It keeps a stockpile of a universally accepted currency, something that other nations trust and are willing to accept. This stored currency is reliable, stable, and most importantly, can easily be converted into other currencies. For a long time, that reliable currency has been the U.S. Dollar.

This universally accepted currency that Imaginaria holds? That, dear reader, is what we call a reserve currency.

Why is Reserve Currency Important?

Now, you may ask, why do countries need a reserve currency? That’s a great question. Here’s why:

- Trade: As we mentioned, Imaginaria can use this currency to trade efficiently with other nations, bypassing the need to exchange currencies every time.

- Stability: Reserve currencies, like the U.S. dollar, are generally more stable. This means countries can protect their economies from fluctuations in their local currency by keeping reserves in a more stable foreign currency.

- Trust: It’s a matter of trust. Reserve currencies are usually issued by economically stable countries. Hence, holding these currencies is seen as a safer bet by countries around the world.

- Debt: Countries often hold debt in reserve currencies. This makes their debt more appealing to foreign investors.

So, when we say that Bitcoin is replacing the USD as the world reserve currency, it means countries are now holding Bitcoin for these same reasons. Can you grasp the magnitude of this change?

Feel free to drop any questions you have in the comments section. We’re here to make this journey as clear and exciting as possible for you!

In the next section, we’ll look at why Bitcoin, out of all the cryptocurrencies and traditional choices, became the world’s reserve currency. Stay tuned!

History of USD as the World Reserve Currency

Ever since the Bretton Woods agreement back in 1944, the U.S. Dollar has enjoyed the privileged status of being the world’s primary reserve currency. For over seven decades, the mighty dollar has been the star player on the global financial stage, influencing international commerce, central bank reserves, and global market liquidity.

But nothing lasts forever, and even the greenback’s reign has seen its sunset.

Rise of Bitcoin – A Timeline

Enter Bitcoin, the digital, decentralized currency that emerged from the brilliant mind (or minds) of an entity named Satoshi Nakamoto back in 2009. But Bitcoin’s climb to the top hasn’t been a steady, uphill journey. It’s been a rollercoaster of dizzying highs and terrifying lows. Yet, through all the volatility, Bitcoin has not just survived – it’s thrived.

Within just over a decade, Bitcoin went from an obscure concept understood by a small niche of tech enthusiasts to a viable contender for the global reserve currency. Yes, Bitcoin has graduated from being dismissed as ‘magic internet money’ to dethroning the USD from its seven-decade reign. Let that sink in for a moment.

Bitcoin Replaces USD. Why?

Factors Contributing to Bitcoin’s Rise

At this point, you might be asking, “Why Bitcoin? What makes it a worthy successor to the USD?” That’s a great question. Bitcoin’s rise has been a result of several factors, including technological advancements, shifting perceptions of digital assets, and of course, growing disillusionment with traditional financial systems.

The decentralization and transparency provided by blockchain technology have been particularly attractive, offering a level of financial control and freedom that traditional banking systems just can’t compete with. And let’s not forget the ability of Bitcoin to cross borders effortlessly, making it a truly international currency.

Comparison: Bitcoin vs USD

But how does Bitcoin stack up against the USD? In one corner, we have the USD, backed by the U.S. government, influenced by monetary policies and with its value linked to the physical economy. In the other corner, we have Bitcoin, a purely digital asset with a finite supply, not tied to any government or central authority.

Bitcoin’s decentralized nature means it’s not subject to governmental controls or inflationary policies. It also offers anonymity (well, pseudonymity to be precise) and lower transaction fees, especially for cross-border transactions. These are just some of the reasons why Bitcoin is winning over the USD.

Advantages of Bitcoin as a Reserve Currency

So why does Bitcoin earn this global badge of honor? The answer lies in its advantages. For one, Bitcoin is free from any government control, which means no nasty inflationary surprises or monetary policies can disrupt its value. It’s essentially a monetary democracy – powered and controlled by the people who use it.

Bitcoin also offers something unprecedented – absolute scarcity. Unlike traditional currencies that can be printed at will, Bitcoin has a hard cap of 21 million coins. This built-in deflationary nature potentially makes Bitcoin a safer store of value, and let’s be honest, who doesn’t love exclusivity?

Plus, the global and digital nature of Bitcoin makes it easily accessible, and its blockchain backbone ensures transactions are transparent and secure. And these are just the highlights!

Impact on Global Economy

But let’s not stop at the ‘why.’ The ‘so what?’ is equally, if not more, intriguing. What does Bitcoin replacing the USD as the reserve currency mean for the global economy?

For starters, it’s likely to reduce the economic dominance of individual countries. With Bitcoin, no single country can manipulate the world’s reserve currency for its advantage – that’s a game-changer right there.

Also, Bitcoin could potentially democratize the global financial system. Traditional banking has often ignored those without access to financial services. But with a digital wallet and internet connection, anyone can hop onto the Bitcoin train, breaking down barriers and promoting financial inclusion.

Potential Challenges and Concerns

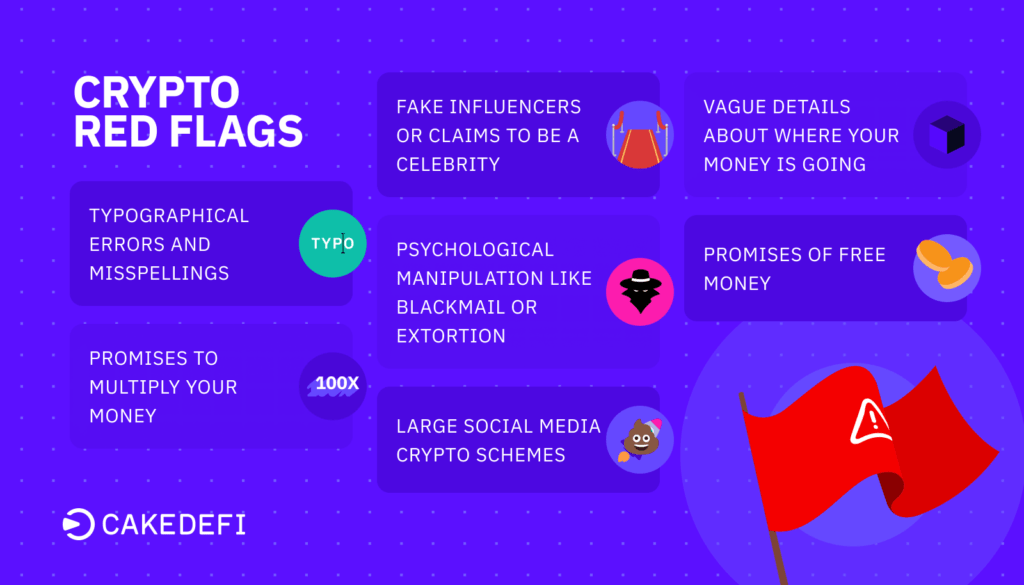

Now, I’m not one to spoil a party, but we should consider the potential speedbumps on this shiny, new Bitcoin road. Bitcoin, for all its advantages, is still a volatile asset. Its value can swing wildly, which might be an adrenaline rush for risk-loving traders but could be stomach-churning for those looking for stability in a reserve currency.

Then there’s the regulatory limbo. While some countries have embraced Bitcoin with open arms, others are more hesitant, grappling with concerns over financial security, money laundering, and tax evasion.

And we can’t ignore the elephant in the room – technology. Issues such as scalability and energy consumption need to be tackled for Bitcoin to sustain its new status in the long run.

Reactions and Comments from Financial Leaders

Bitcoin’s new reign has sent ripples across the global financial pond. And as expected, reactions vary. The crypto world, of course, is jubilant. Take, for instance, Cathie Wood of Ark Investment, who boldly stated, “Bitcoin’s ascension to the status of world reserve currency is not a question of ‘if’, but ‘when’.”

On the other hand, traditional financial leaders are more cautious. Christine Lagarde, President of the European Central Bank, voiced concerns over Bitcoin’s volatility, stating, “Bitcoin is not a currency, it’s a highly speculative asset.”

The Future of Bitcoin and Cryptocurrency

So, what does the future look like in this new Bitcoin-dominated landscape? If we’re being honest, no one really knows. But the potential implications are nothing short of revolutionary.

With Bitcoin leading the charge, we’re likely to see a surge in blockchain-based innovations. Decentralized finance (DeFi) is already hinting at what’s possible, and this is just the tip of the iceberg. What’s certain, though, is that the world of finance will never be the same again.

Read Also: Crypto Trading For Beginners

Crypto Trading Terms You Should Know- Crypto Trading Glossary

Closing Thoughts

In this thrilling financial rollercoaster, we find ourselves at a pivotal moment, standing on the precipice of change. Bitcoin’s rise to the status of the world’s reserve currency is a testament to the power of technology, people’s belief in financial freedom, and the allure of the unknown.

And as we step into this new world, it’s essential to remember that while the landscape is changing, the fundamental principles of finance remain the same – diligence, diversification, and caution are still your best friends in this brave new world.

Frequently Asked Questions

Now, let’s address some common queries you might have about this seismic shift in global finance:

1. How did Bitcoin become the world’s reserve currency?

Bitcoin’s ascension can be attributed to a confluence of factors including technological advancements, growing investor interest, economic uncertainties, and a shift in perception towards cryptocurrencies. For a deeper dive, check out our previous article on Bitcoin’s rise.

2. Is Bitcoin a safe investment?

Like any investment, Bitcoin carries risks, particularly due to its price volatility. However, many view it as a “digital gold,” a safe haven asset that could potentially safeguard against inflation. Always do your research and consider seeking advice from financial professionals before investing. You can learn more here.

3. What are the implications of this shift for traditional banks?

The rise of Bitcoin could potentially disrupt traditional banking. However, many financial institutions are evolving to incorporate cryptocurrencies into their services. The future of banking may well be a hybrid model combining the best of both worlds.

4. What does this mean for the average person?

For the everyday person, the shift to Bitcoin could mean easier access to financial services, especially for those currently underserved by traditional banking. But, it’s also a wake-up call to become financially literate in this new digital realm. Check out our beginner’s guide to Bitcoin for more information.

5. Where can I buy Bitcoin?

Bitcoin can be bought on a variety of online platforms. Check out our article on the top Bitcoin exchanges for a comprehensive comparison and guide.

Remember, change is the only constant. So, let’s embrace this Bitcoin era with open minds and informed decisions. Stay curious, stay informed, and most importantly, stay excited – the future is here!

This is the start of a new financial chapter, and you are a part of it. Whether Bitcoin’s reign as the world reserve currency will stand the test of time remains to be seen, but one thing is for sure – we’re living in exciting times! So, let’s buckle up and enjoy the ride!

What are your thoughts on Bitcoin’s new status? Share your views in the comments section below. And, don’t forget to share this article with your friends who might find this useful. Let’s spread the knowledge!

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  USDC

USDC  Lido Staked Ether

Lido Staked Ether