Have you ever considered how secure your cryptocurrency truly is? As the popularity of digital assets continues to rise, the importance of safeguarding your investments has never been greater. Understanding the various methods to secure your cryptocurrency, particularly through cold storage solutions, can significantly enhance your protection against theft and loss.

Understanding Cold Storage

Cold storage refers to methods of storing cryptocurrency offline. This approach minimizes exposure to potential hacks, malware, and online threats that can compromise digital assets. By keeping your private keys away from the internet, you substantially decrease the risk of unauthorized access.

Why Cold Storage?

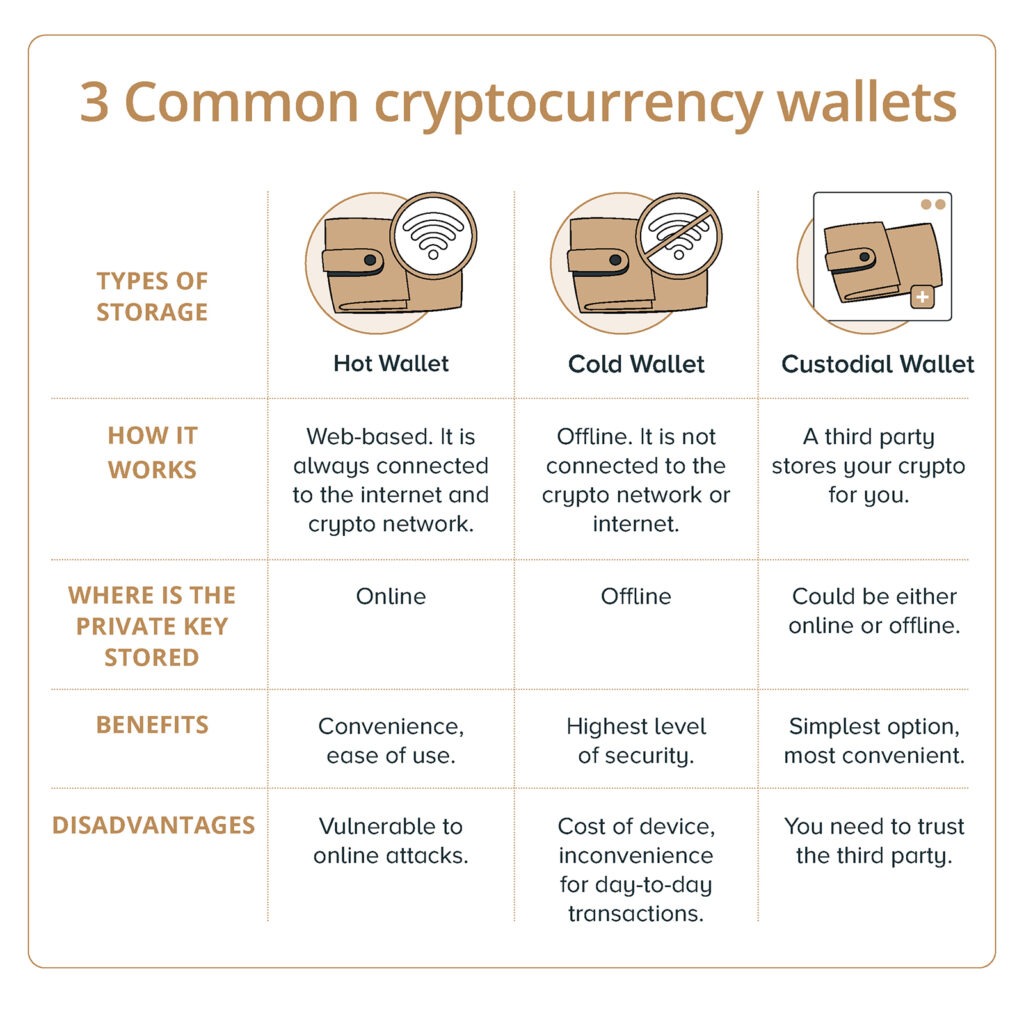

The primary advantage of cold storage is its ability to offer superior security. Unlike hot wallets, which are connected to the internet, cold wallets store your assets offline. This distinction makes them less susceptible to cyberattacks. For investors looking to hold significant amounts of cryptocurrency, cold storage can be an invaluable option.

The choice between hot and cold storage often comes down to the frequency of transactions and the level of security desired. If you are an active trader, hot wallets may provide the convenience you need. However, for long-term holding, cold storage represents the best practice.

Types of Cold Storage

Several methods for cold storage exist, each with its advantages and disadvantages. Understanding these options will allow you to choose the best fit for your requirements.

Hardware Wallets

Hardware wallets are specialized devices designed to store your cryptocurrency offline securely. They generate and store private keys, allowing you to sign transactions without exposing your sensitive information to the internet.

| Feature | Pros | Cons |

|---|---|---|

| Security | Very high level of protection | Physical loss or damage risk |

| Usability | User-friendly interfaces | May require initial investment |

| Backup Options | Recovery phrases available | Vulnerable to physical theft |

Popular brands include Trezor and Ledger, both known for robust security features.

Paper Wallets

A paper wallet consists of physical printouts of your public and private keys. This method provides a completely offline solution, making it highly secure from digital threats.

| Feature | Pros | Cons |

|---|---|---|

| Security | Immune to digital attacks | Risk of physical damage or loss |

| Cost | Free to create | Not user-friendly, complicated recovery |

| Usability | Simple and straightforward | Requires meticulous care and handling |

To create a paper wallet, you can use tools like Bitaddress.org or WalletGenerator.net. Always ensure that you generate them in a secure environment.

Air-Gapped Devices

An air-gapped device is a computer that has never been connected to the internet, eliminating the risk of online attacks. By storing your cryptocurrency wallet on such a device, you create a safe haven for your assets.

| Feature | Pros | Cons |

|---|---|---|

| Security | Extremely high level of protection | Requires setup and technical knowledge |

| Control | Complete control over your funds | Configuring may be complex |

| Recovery | Backup methods available | Risk of hardware failure |

Secure Element Wallets

These wallets use specialized chips designed to handle cryptographic keys securely. Secure element wallets provide additional security features such as encryption and tamper resistance.

| Feature | Pros | Cons |

|---|---|---|

| Security | Very high, resistant to physical attacks | Higher price point |

| Performance | Fast transaction processing | Limited availability for some currencies |

| Usability | Typically user-friendly | Risk of reliance on manufacturer |

When choosing a secure element wallet, consider models like the Ledger Nano series.

Setting Up Cold Storage

Once you have selected a cold storage method, it is imperative to set it up correctly to ensure maximum security.

Creating Secure Backups

Regardless of which cold storage solution you choose, creating secure backups of your private keys is crucial. This process involves several steps:

- Generate a New Wallet: Use a trustworthy software or hardware wallet to create a new wallet. Take note of the recovery phrase provided.

- Securely Store the Recovery Phrase: Write down your recovery phrase and store it in a safe location, such as a safe or safety deposit box.

- Avoid Digital Copies: Do not store your recovery phrases or private keys on your computer or online platforms. Doing so increases your risk of exposure.

Setting Transaction Limits

Some wallets allow you to establish daily or transaction limits, providing an extra layer of protection. By doing this, you can mitigate losses in the event of a security breach.

Testing Your Storage

Once your cold storage is set up, it is wise to test it. Transfer a small amount of cryptocurrency to your new wallet and attempt to access it to ensure everything works correctly. This test provides peace of mind before moving larger amounts.

Best Practices for Ensuring Security

In addition to utilizing cold storage solutions, following these best practices can bolster your cryptocurrency security.

Regular Software Updates

If you use any hardware or software wallet, consistently update your devices. Software updates often include critical security patches that protect against vulnerabilities.

Use Multi-Signature Wallets

Multi-signature wallets require multiple private keys to approve a transaction. This technology increases security by ensuring that one compromised key alone cannot result in loss.

Avoid Public Wi-Fi

Never access your wallets or conduct transactions over public Wi-Fi networks, as these can be easily compromised. Always use secure, private connections.

Conduct Periodic Security Audits

Review your cryptocurrency holdings and security practices on a regular basis. Conducting security audits helps identify potential weaknesses in your storage solution or access methods.

Common Security Threats

Recognizing common threats helps you better protect your cryptocurrency. Awareness of these threats will allow you to adopt appropriate countermeasures.

Phishing Attacks

Phishing attacks involve deceptive emails or websites designed to trick users into sharing personal information or private keys. Always double-check URLs and verify that you are using official platforms before entering sensitive data.

Malware

Malware can infiltrate your systems and potentially monitor your key presses or clipboards. Use trusted antivirus software to scan for malware regularly, and ensure your devices are protected.

Social Engineering

Social engineering tactics include manipulating victims into divulging confidential information. Be cautious when sharing personal details, and remain skeptical of unsolicited communications.

Physical Theft

Secure your hardware wallets and paper wallets in a safe place to protect against physical theft. Consider using tamper-proof seals or, for greater security, a multi-signature setup.

Recovery Options

In the unfortunate event that you lose access to your cryptocurrency wallet, it is crucial to have a recovery plan in place.

Using Recovery Phrases

The recovery phrase provided when you set up your wallet is your primary means of restoring access. Keep this phrase private but accessible. If you lose your wallet, the recovery phrase will allow you to regain access to your assets.

Customer Support

If applicable, reach out to the customer support of your wallet provider. They may have recovery solutions or guidance based on your situation.

Legal Considerations

Familiarize yourself with legal options regarding lost cryptocurrency. Understanding your rights can provide avenues for recourse or recovery in unfortunate circumstances.

Conclusion

Securing your cryptocurrency through cold storage and adhering to best practices enhances your investment’s safety. The methods of cold storage, including hardware wallets, paper wallets, air-gapped devices, and secure element wallets, each have unique features that cater to various investor needs.

By prioritizing security through regular updates, the use of multi-signature wallets, and awareness of common threats, you can significantly minimize risk. Additionally, establishing a solid recovery plan will ensure that your investments are safeguarded against unexpected events.

With the increasing prevalence of digital assets, taking these steps today can lead to greater peace of mind tomorrow. Ensure that you are fully informed and equipped to navigate the world of cryptocurrency securely. Your diligence and proactive measures will go a long way in safeguarding your financial future.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether