What steps are you taking to safeguard your cryptocurrency investments in an ever-evolving financial landscape?

Understanding Decentralized Finance (DeFi)

Decentralized Finance, commonly known as DeFi, represents an innovative shift in the financial sector by leveraging blockchain technology. Unlike traditional finance that relies on intermediaries such as banks, DeFi enables peer-to-peer transactions, allowing users to lend, borrow, and trade directly through decentralized applications (dApps). This direct access to financial services comes with its own set of benefits and risks, particularly when it comes to protecting your investments.

What Makes DeFi Different?

DeFi platforms operate on blockchain technology, primarily Ethereum, which allows for the creation of smart contracts. Smart contracts are self-executing agreements with the terms directly written into code, eliminating the need for intermediaries and promoting transparency and security. However, as with any emerging sector, the rapid growth of DeFi has also resulted in vulnerabilities and risks, prompting the need for insurance solutions tailored specifically for this domain.

The Risks Involved in DeFi Investments

Before considering insurance options, it is essential to understand the numerous risks associated with DeFi investments. Recognizing these risks can help you make informed decisions when insuring your assets.

Smart Contract Vulnerabilities

Smart contracts, while revolutionary, are not infallible. Poorly coded contracts can introduce vulnerabilities that exploit the underlying system, leading to significant financial losses. You must conduct thorough research and due diligence before engaging with any DeFi project.

Market Volatility

Cryptocurrency markets are notoriously volatile. Price fluctuations can happen within moments, greatly affecting the value of your investments. While volatility may offer opportunities for profit, it equally poses substantial risks, highlighting the need for protection through insurance.

Regulatory Challenges

DeFi exists in a regulatory gray area in many jurisdictions. As governments work to establish frameworks around cryptocurrencies, you face uncertainties regarding compliance and legal implications. Regulatory changes can have significant impacts on the usability and value of DeFi investments.

Hacks and Exploits

DeFi platforms have been prime targets for hacking incidents. Cybercriminals exploit vulnerabilities in smart contracts or protocols, leading to substantial financial losses for investors. Knowing how to protect yourself from such risks is crucial.

Liquidity Risks

In DeFi, liquidity refers to how easily assets can be converted to cash without affecting their market price. Low liquidity can hinder your ability to sell assets during market downturns, increasing potential losses. Insurance can serve as a mechanism to mitigate such risks.

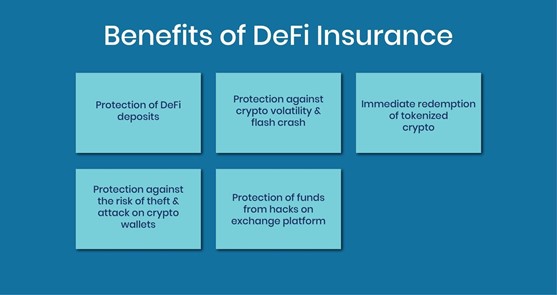

What is DeFi Insurance?

DeFi insurance is designed to protect your investments against specific risks inherent in decentralized finance. As the industry continues to evolve, various insurance protocols have emerged to provide coverage options for users and their assets.

Types of Coverage Offered

Different insurance products cater to various risks. The insurance coverage available may include protection against smart contract failures, hacking incidents, and even governance risks associated with decentralized applications.

Smart Contract Coverage

This type of coverage protects you against losses incurred due to vulnerabilities within smart contracts. If a smart contract failure occurs, the insurance payout helps you recover some or all of your investment.

Hacking and Exploit Coverage

Insurance solutions focusing on hacking and exploits cover losses that occur when a DeFi platform is compromised. Should a breach as a result of hacking happen, you are financially compensated to mitigate the impact of your losses.

Governance Risk Coverage

In decentralized platforms, governance tokens allow you to influence decision-making processes. Governance risk coverage provides protection against the negative outcomes of poorly executed proposals or voting outcomes that lead to a decline in asset value.

How DeFi Insurance Works

Understanding how DeFi insurance functions helps you make sound decisions when it comes to protecting your investments. Here’s a breakdown of the essential elements involved.

Premiums and Policies

Just like traditional insurance, you must pay premiums to access DeFi insurance. The amount you pay typically depends on the amount insured, the perceived risk of the underlying assets, and the coverage terms selected. Policies may vary widely depending on the insurance provider and the risks covered.

Claims Process

In the event of a loss, the claims process for DeFi insurance involves filing a claim with your insurance provider. You must present relevant evidence, such as transaction records and contract details, to substantiate your claim. Insurance providers typically have specific timelines for processing claims.

Payout Mechanisms

Payouts may differ based on the nature of the loss and the specific terms of the policy. Some insurance protocols use automated mechanisms, while others require manual intervention. Familiarizing yourself with payout structures aids in understanding how quickly you can expect a response to your claim.

Leading DeFi Insurance Protocols

Several DeFi insurance platforms and protocols have emerged, each with its own unique features and offerings. It is essential for you to conduct thorough research on available options to choose the one that best meets your protection needs.

Nexus Mutual

Nexus Mutual is one of the most well-known DeFi insurance platforms. It operates on a mutual model, allowing members to share risk with one another. Users can buy coverage for smart contract vulnerabilities and hacking incidents. Nexus Mutual’s decentralized approach fosters transparency and user engagement, as policyholders can participate in decision-making.

Cover Protocol

Cover Protocol offers an on-demand insurance product. Users can purchase coverage for specific risks associated with DeFi projects. This flexibility allows you to customize coverage based on your investment strategy, ensuring that you are adequately protected.

InsurAce

InsurAce provides comprehensive insurance solutions across various DeFi protocols. The platform operates with a unique token model that incentivizes insurance providers. InsurAce emphasizes user experience, offering a wide range of coverage options and streamlined claims processing.

Etherisc

Etherisc focuses on creating decentralized insurance products for various sectors, including DeFi. They utilize smart contracts to automate various aspects of insurance, making the entire process more efficient. Etherisc’s model underscores the power of tailoring insurance solutions to the evolving landscape.

Selecting the Right DeFi Insurance Provider

With numerous options available, how do you determine the most suitable insurance provider for your needs? A systematic approach will enable you to make a well-informed choice.

Assess Your Investment Risks

Conduct a thorough assessment of the specific risks associated with your DeFi investments. Understanding your exposure allows you to select the appropriate coverage. Consider your investment size, diversity, and the platforms you engage with.

Evaluate Coverage Options

Review the coverage options offered by different insurance providers. Look for products that align with your risk profile and ensure they efficiently address your unique needs. Pay attention to exclusions, limits, and deductibles that may apply in the insurance policy.

Research the Provider’s Reputation

Investigate the reputation of potential insurance providers. Seek out user reviews, online community discussions, and transparency in their operations. Check whether the provider has a track record of honoring claims and maintaining fair practices.

Examine Claims Process

A clear and efficient claims process is essential for accessing support when needed. Review the claims process of potential providers and assess how well it meets your expectations. Inquire about timelines and required documentation for filing claims.

Understand Policy Costs

Finally, carefully consider the costs associated with obtaining insurance coverage. Compare premium rates across various providers, taking note of the value offered by each policy. Ensure that the potential coverage justifies your expenditure.

The Future of DeFi Insurance

As DeFi continues to gain traction, the demand for insurance solutions is likely to grow. Providers will need to adapt their offerings in response to emerging risks, regulations, and user needs.

Technological Advancements

Continuous advancements in blockchain technology may enhance the capabilities and efficiencies of insurance protocols. As the industry matures, we can expect improved algorithms for risk assessment, claims processing, and payout mechanisms.

Integration with Traditional Finance

Integration of DeFi insurance into traditional financial systems may occur as regulations evolve. Such developments could lead to hybrid insurance products, offering a broader range of security for a diverse range of investors.

Educational Initiatives

A continued emphasis on educating investors about the importance of DeFi insurance will also play a critical role in the industry’s growth. Enhanced understanding will empower individual investors to make informed decisions about protecting their assets.

Conclusion

By implementing effective risk management strategies, including DeFi insurance, you can better safeguard your cryptocurrency investments. As the DeFi landscape evolves, staying informed and continuously assessing your exposure to potential risks will enable you to make proactive decisions.

Investing in insurance tailored to DeFi not only protects your assets but also fortifies the entire ecosystem by promoting responsible investing. As you navigate this dynamic and rapidly changing space, being equipped with the right knowledge and tools will help you protect what you have worked so hard to achieve.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether