In today’s rapidly evolving financial landscape, investors often find themselves at a crossroads, trying to decide between traditional stocks and the more modern cryptocurrency.

The debate on “Cryptocurrency vs Stock Market” is gathering steam, and if you’re caught in this problem, you’re not alone. This article dives deep into both investment avenues, highlighting their pros and cons to help you make an informed decision.

Table of Contents

Understanding the Basics

What is the Stock Market?

The stock market is a place where people buy and sell shares of companies. These shares show that you own a part of that company. If the company does well or poorly, the value of your shares will go up or down.

What is Cryptocurrency?

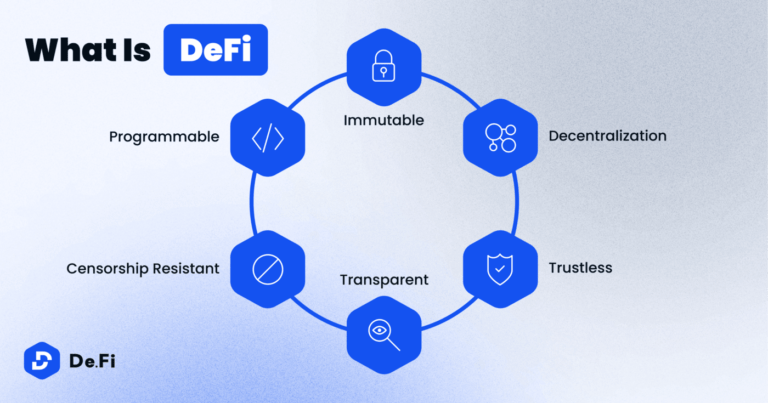

Cryptocurrency, conversely, is a digital or virtual currency that uses cryptography for security. Unlike fiat currencies controlled by central banks, most cryptocurrencies operate on decentralized platforms.

The Pros and Cons of Each Investment Type

Stock Market Advantages

- Historical Performance: Stocks have a long history of providing an excellent long-term return on investment, especially when you reinvest dividends.

- Dividends: Some stocks provide tips, offering a source of passive income.

- Regulation: Stocks are regulated by government entities, offering a degree of protection to investors.

Stock Market Disadvantages

- Volatility: Though less volatile than cryptocurrencies, stock markets can still experience significant ups and downs.

- The barrier to Entry: Accessing stock markets can be challenging in some countries without significant capital.

Cryptocurrency Advantages

- High Potential Returns: Cryptocurrencies can offer substantial returns within short periods.

- Liquidity: With 24/7 trading, cryptocurrencies provide high liquidity.

- Decentralization: Without central control, cryptocurrencies can be less susceptible to government monetary policies.

Crypto Disadvantages

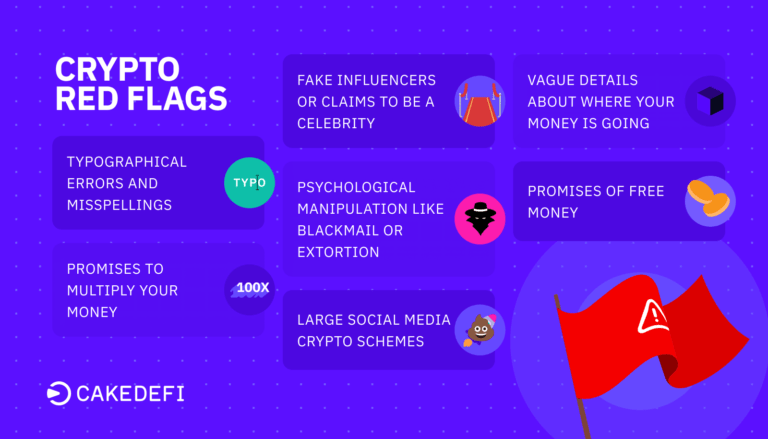

- High Volatility: Cryptocurrencies can be highly volatile, leading to significant losses.

- Lack of Regulation: This can lead to potential scams or loss of investments without recourse.

- Technological Risks: Tech problems, like losing a digital wallet or issues with the blockchain, can be risky.

Cryptocurrency vs Stock Market: Making Your Decision

Your choice between the stock market and cryptocurrency should hinge on your investment goals, risk appetite, and time horizon.

- For Long-term Stability: If you’re looking for a tried-and-tested avenue that can weather occasional market downturns, stocks might be your best bet.

- For High-Risk, High-Reward: If you’re open to taking risks for potentially higher short-term rewards, consider diving into cryptocurrency

Investment Strategies: Diversification and Risk Management

Diversification is a key principle in investment strategy that involves spreading your investments across different asset classes to mitigate risks. In the context of the cryptocurrency vs stock market debate, diversification takes on added significance. By combining both traditional stocks and cryptocurrencies in your portfolio, you can potentially offset the volatility of one with the stability of the other.

Benefits of Diversification:

- Risk Mitigation: Diversification helps reduce the impact of poor performance in a single asset class. If one market experiences a downturn, the other may remain stable or even thrive.

- Potential for Higher Returns: A well-diversified portfolio can offer the potential for higher overall returns. When one asset class performs exceptionally well, it can offset losses in another.

- Hedging Against Uncertainty: Cryptocurrencies and traditional stocks often respond differently to economic and market events. Having exposure to both can provide a hedge against uncertainties that may impact one market more significantly than the other.

Risk Management Strategies:

- Asset Allocation: Determine the percentage of your portfolio allocated to stocks and cryptocurrencies based on your risk tolerance and investment goals. Consider rebalancing periodically to maintain your desired allocation.

- Staggered Investments: Instead of investing a lump sum, consider a phased approach. Invest a portion of your capital at intervals, allowing you to capitalize on potential market dips and volatility.

- Continuous Learning: Stay informed about the developments in both markets. Regularly update yourself on the latest news, trends, and regulations that might affect your investments.

Section: Regulatory Landscape and Market Maturity

Understanding the regulatory environment and the maturity level of each investment avenue is crucial for making informed decisions. Both the stock market and cryptocurrencies operate within distinct regulatory frameworks, and assessing their maturity can provide insights into their potential risks and rewards.

Regulation in the Stock Market:

- Government Oversight: Stock markets are subject to government regulations and oversight, offering investors a level of protection against fraudulent activities.

- Maturity: Stock markets have a well-established history and are considered relatively mature, with a track record of stability and resilience through various market cycles.

- Transparency: Publicly traded companies are required to disclose financial information, making it easier for investors to evaluate their performance and make informed decisions.

Regulation in the Cryptocurrency Market:

- Varied Regulatory Landscape: Cryptocurrency regulations vary widely across jurisdictions, leading to potential legal uncertainties. Research the regulations in your country before investing.

- Evolving Landscape: The cryptocurrency market is relatively young and continually evolving. New projects and technologies emerge frequently, adding to the complexity of the ecosystem.

- Innovation and Risk: While innovation drives the cryptocurrency market, it also presents risks, including potential regulatory changes and technological vulnerabilities.

By considering the regulatory environment and the maturity of both investment options, you can better assess the level of security, stability, and potential for growth that each avenue offers. This informed perspective can guide your decision-making process and help you align your investments with your financial goals and risk tolerance.

Also Read this Blog: How to Start Bitcoin Mining: A Guide for Beginners

Wrapping Up the Cryptocurrency vs Stock Market Debate

As the financial landscape evolves, the distinctions between traditional and digital investments grow starker, making decisions more complex for investors. Both the stock market and cryptocurrencies come with their unique sets of advantages and challenges.

The stock market, backed by a rich history of stability and regulatory structures, often appeals to those who prioritize long-term wealth growth and seek a sense of familiarity in their investments. Dividends, corporate governance, and the sheer diversity of sectors available for investment further augment its attractiveness.

Cryptocurrencies, in contrast, epitomize the digital frontier – laden with potential for high returns but equally susceptible to significant volatility. The allure of decentralization, the potential for quick profits, and the promise of an emerging financial paradigm are hard to ignore.

But as we dissect the “Cryptocurrency vs Stock Market” discussion, it becomes evident that the best investment path hinges on individual preferences, risk tolerance, and financial goals. For some, a balanced portfolio that straddles both worlds may offer the optimal blend of stability and growth. For others, a committed dive into one over the other might resonate more.

Your best allies will be informed decision-making, diligent research, and staying attuned to global financial currents. Whether you lean towards the stock market’s time-tested allure or the dynamic pulse of cryptocurrency, remember that the investment journey is not just about the destination but also the insights and experiences along the way.

FAQ: Cryptocurrency vs Stock Market Debate

1. What is the debate about “Cryptocurrency vs Stock Market” all about? This debate centers on choosing between traditional stocks and modern cryptocurrencies as investment options. The article delves into the pros and cons of each avenue to help readers make informed investment decisions.

2. What is the stock market? The stock market is a platform where individuals buy and sell shares of companies. Owning shares represents ownership in a company, and their value can fluctuate based on the company’s performance.

3. What is cryptocurrency? Cryptocurrency is a digital or virtual currency that employs cryptography for security. Unlike traditional fiat currencies, most cryptocurrencies operate on decentralized platforms.

4. What are the advantages of investing in the stock market? Advantages of the stock market include historical performance, dividends for passive income, and regulation that provides investor protection.

5. What are the disadvantages of the stock market? Stock market disadvantages encompass volatility, potential entry barriers, and susceptibility to market downturns.

6. What are the advantages of investing in cryptocurrency? Advantages of cryptocurrency investments include potential high returns within short periods, high liquidity due to 24/7 trading, and decentralization that reduces government influence.

7. What are the disadvantages of investing in cryptocurrency? Cryptocurrency disadvantages involve high volatility leading to losses, lack of regulation leading to scams, and technological risks such as wallet loss or blockchain issues.

8. How can I decide between cryptocurrency and the stock market? Your decision should consider your investment goals, risk appetite, and time horizon. For stability and long-term growth, stocks might be preferable, while those seeking high-risk, high-reward opportunities could consider cryptocurrencies.

9. How does the article conclude the cryptocurrency vs stock market debate? The article highlights that the decision between these two investment options depends on individual preferences, risk tolerance, and financial goals. It emphasizes informed decision-making, research, and staying updated with global financial trends.

10. Is there a recommendation for a balanced approach to investing? The article suggests that some investors might find a balanced portfolio that includes both traditional stocks and cryptocurrencies to be an optimal strategy, combining stability and growth potential.

11. How does the article encourage readers to approach their investment journey? The article underscores that the investment journey is about more than just the destination. It highlights the importance of insights and experiences gained along the way, emphasizing the significance of informed decision-making and adaptability.

12. How can I get more information about specific investment options? For more detailed information about stocks or cryptocurrencies, consider conducting thorough research, consulting financial experts, or seeking resources that provide in-depth insights into each investment avenue.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether