Table of Contents

In the dynamic world of cryptocurrency, staying ahead of the curve means knowing where to place your investments. If you’re looking for the best cryptocurrencies to invest in 2023, you’ve come to the right place. This blog article will provide an in-depth overview of what we believe to be the top ten cryptocurrencies that hold significant potential in 2023.

Please note: The information in this article should not be taken as financial advice. Please do your own research or consult a professional financial advisor before making any investment decisions.

1. Bitcoin (BTC)

Despite numerous challenges, Bitcoin remains the dominant player in the crypto space. As the first and largest cryptocurrency, it’s become a kind of “digital gold”. It has shown remarkable resilience over the years and continues to be a safe bet for many investors, making it one of the best cryptocurrencies to invest in for 2023.

2. Ethereum (ETH)

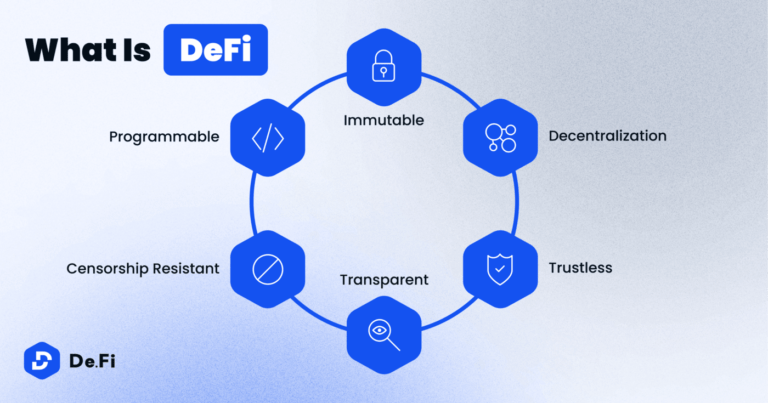

Ethereum is not just a cryptocurrency. It’s also a platform for creating decentralized applications (DApps) and executing smart contracts. With Ethereum 2.0 on the horizon, promising to increase transaction speed and decrease fees, ETH is potentially a great investment opportunity in 2023.

3. Binance Coin (BNB)

As the native coin of the Binance exchange, BNB has been growing steadily. Binance Coin offers a wide range of use cases, including fee discounts on the Binance exchange, making it valuable to those who trade cryptocurrencies frequently.

4. Cardano (ADA)

With its research-first approach, Cardano aims to solve many of the largest issues facing cryptocurrencies today: scalability, interoperability, and sustainability. Driven by a strong development team, Cardano has the potential for substantial growth.

5. Polkadot (DOT)

Polkadot aims to enhance interoperability among other blockchains while allowing them to share information and functionalities. Its multi-chain architecture could potentially make it a key player in the future blockchain ecosystem.

6. Ripple (XRP)

Ripple’s XRP is designed to facilitate faster, low-cost international money transfers. With an increasing number of financial institutions showing interest in Ripple’s payment protocol, XRP is a cryptocurrency to keep an eye on.

7. Chainlink (LINK)

As a leading Oracle network, Chainlink allows smart contracts on Ethereum to securely connect to external data sources, APIs, and payment systems. With DeFi (decentralized finance) growth, LINK, the native token, has significant potential.

8. Litecoin (LTC)

Often considered the silver to Bitcoin’s gold, Litecoin offers faster transaction confirmation times and a different hashing algorithm. If the cryptocurrency market rallies, Litecoin could be one of the major beneficiaries.

9. Uniswap (UNI)

Uniswap is one of the top decentralized exchange (DEX) projects in the crypto space. It allows for the exchange of ERC20 tokens directly from liquidity pools. The UNI token, the native token of Uniswap, has substantial growth potential with the surge of DeFi.

10. Aave (AAVE)

Aave is a leading player in the DeFi space, offering services such as flash loans, interest rate swapping, and more. With DeFi becoming increasingly popular, Aave and its native token, AAVE, should be on any crypto investor’s radar.

Making Your Investment Decision

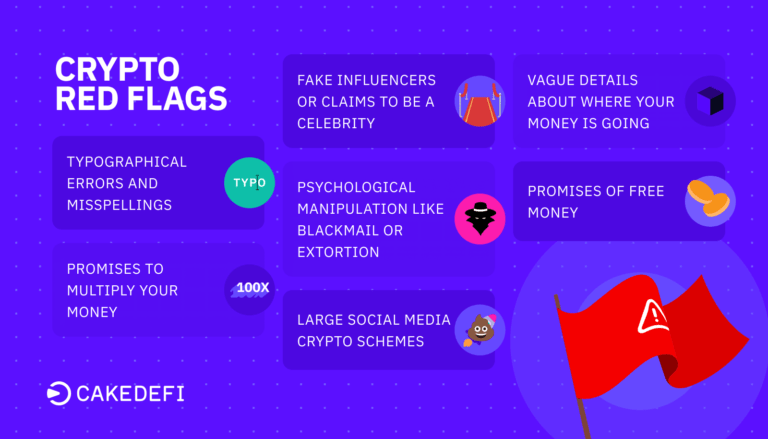

When considering the best cryptocurrencies to invest in 2023, it’s essential to remember that cryptocurrency investments carry significant risk due to their volatility. Never invest more than you can afford to lose, and always do your own research or consult with a financial advisor before making any investment decisions.

The cryptocurrencies listed above represent some of the most promising projects in space, but they are just the tip of the iceberg. There are thousands of potential investments out there, each with its unique risks and rewards.

Cryptocurrencies can offer incredible returns, but they also come with their fair share of risks. Diversify your portfolio, understand what you’re investing in, and remember: in the world of cryptocurrencies, knowledge truly is power.

Also Read this Blog: What is Cryptocurrency and How Does It Work? Everything You Need to Know in 2023

How to invest in Cryptocurrency: Best Cryptocurrencies to Invest in 2023

Investing in cryptocurrency can be an exciting venture with the potential for significant returns. However, it’s also a complex and volatile market that requires careful planning and thorough research. Here are some key steps to guide you on how to invest in cryptocurrency:

1. Understand the Basics: Before you start investing, it’s crucial to understand what cryptocurrency is, how blockchain technology works, and the concepts of decentralization, smart contracts, and digital wallets. Grasping these fundamental concepts will help you make more informed decisions about your investments.

2. Do Your Research: Research is the cornerstone of any successful investment strategy. Given the large number of cryptocurrencies available, thorough research is essential to choose the best options for your portfolio. Evaluate potential investments based on factors like market cap, trading volume, past performance, and future plans. Stay informed about industry news and trends, and familiarize yourself with key industry terms.

3. Choose a Reliable Cryptocurrency Exchange: A cryptocurrency exchange is a platform where you can buy, sell, and trade cryptocurrencies. There are several exchanges to choose from, each with its pros and cons. Some popular options include Binance, Coinbase, and Kraken. When choosing an exchange, consider factors like security measures, user interface, transaction fees, customer support, and the number and types of cryptocurrencies available.

4. Set Up a Wallet: A cryptocurrency wallet is a software application that allows you to store, send, and receive digital currencies. Wallets can be online (web-based) or offline (hardware or software-based). Hardware wallets are considered the safest, but web wallets are more convenient for active trading.

5. Make Your Purchase: Once you’ve set up your account on an exchange and a wallet to store your cryptocurrency, you can proceed with your purchase. Most exchanges allow users to buy cryptocurrencies using fiat currencies or other cryptocurrencies.

6. Diversify Your Portfolio: It’s important not to put all your eggs in one basket. Diversifying your portfolio across a range of cryptocurrencies can help manage risk. While Bitcoin and Ethereum are the most well-known, there are thousands of other coins that may offer substantial returns.

7. Regularly Monitor Your Investments: The cryptocurrency market is highly volatile, and prices can change rapidly. Regularly monitoring your investments can help you stay ahead of these fluctuations and take action when necessary. Consider setting up price alerts on your exchange or wallet app to notify you of significant price changes.

8. Be Patient: Cryptocurrency investing requires patience. While the market can generate significant returns, it can also have periods of downturn. It’s important to invest only what you can afford to lose and not make rash decisions during market fluctuations.

Remember, investing in cryptocurrencies involves risk, just like any other investment. It’s crucial to take a measured approach, do your research, and understand that investing in cryptocurrencies should be a part of a diversified investment strategy. If you’re unsure about how to proceed, consider speaking to a financial advisor with experience in cryptocurrency.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether