As we delve further into the digital age, cryptocurrencies have emerged as a major player in the global financial ecosystem. But with this new form of digital wealth comes the crucial need to understand how to store and safeguard it effectively. After all, what’s the point of investing in these digital assets if you can’t keep them safe?

Whether you’re a seasoned cryptocurrency trader or a complete novice, our comprehensive guide is designed to help you understand how to ‘Store Cryptocurrency Safely’ in 2023.

We will explore various types of crypto wallets and walk you through the best security practices to protect your investments. So, buckle up and get ready to secure your digital assets like a pro.

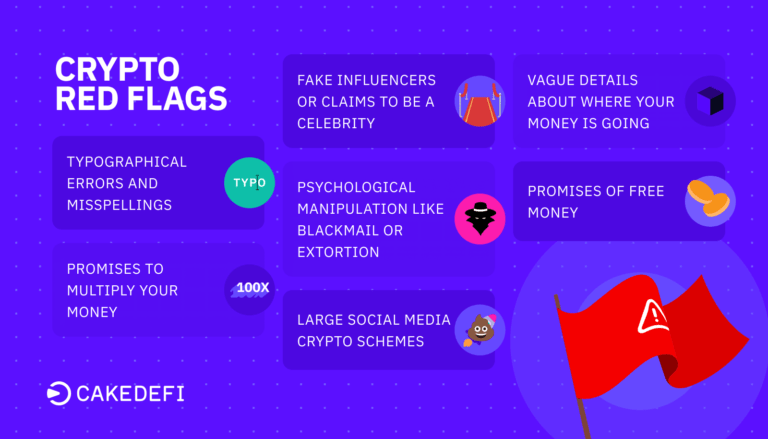

Storing cryptocurrency safely involves understanding the technology you’re using, taking appropriate security measures, and remaining vigilant about threats. It is important to be aware of the unique risks posed by digital assets. Here’s how you can store cryptocurrency safely:

- Use Hardware Wallets: They are the safest way to store your cryptocurrencies. They are physical devices that store your private keys offline. This protects your funds from hacking attempts, as online systems are often prone to cyber-attacks.

- Use Wallets That Allow Ownership of Private Keys: Wallets that give you control over your private keys are generally more secure because they allow you to maintain complete control over your crypto assets.

- Keep Your Software Updated: This applies to the software on your device where you access your wallet or hardware wallet itself. The updated software has the latest security features.

- Secure Your PC: Make sure your PC or smartphone is secure. Regularly update your antivirus software and operating system to protect against malware or hacking attempts.

- Regular Backups: Ensure you regularly back up your wallet in order to protect your cryptocurrency from losses due to hardware failure or accidental deletion.

What Is A Crypto Wallet

A cryptocurrency wallet is a software application (or a hardware device) that allows individuals to store and retrieve their digital assets. Any cryptocurrency transaction is digitally signed for security. Everyone on the network can access the record of this transaction, but only the owner of the private key can sign transactions. In simple terms, a digital wallet is a secure and essential tool for crypto.

Types Of Cryptocurrency Wallets

There are several types of wallets that provide different ways to store and access your digital currency:

1. Hardware Wallets

Hardware wallets are the safest way to store your cryptocurrency. With a hardware wallet, your private keys are stored securely on a physical device, away from internet-connected devices. They are immune to computer viruses, the funds stored cannot be transferred out of the device in plaintext, and in most instances, their software is open source. Examples of hardware wallets include:

Hardware wallets can be a bit of an investment but are a must for people who are storing large amounts of cryptocurrency.

2. Desktop Wallets:

A desktop wallet is a software application that is downloaded and installed on a computer. This kind of wallet allows the user to control their keys directly. You can send, receive, and manage your cryptocurrency from this application. As a wallet that is connected to the internet, it is called a ‘hot’ wallet.

This means it has a slightly higher risk of cyber attacks compared to ‘cold’ wallets (offline). However, as long as your computer is secure and you maintain good digital hygiene habits (like not clicking on suspicious links and keeping your antivirus updated), desktop wallets can provide a decent level of security.

3. Mobile Wallets:

These are like desktop wallets, but they run as an app on your smartphone. They have the added convenience of being portable, meaning you can use cryptocurrencies stored in these wallets to make purchases at physical stores by scanning a QR code.

They can also make use of additional phone features, such as biometric verification, adding an extra layer of security. Some mobile wallets also allow you to store recovery phrases on your device, which can be used to restore your funds if you lose access to your wallet. Just like desktop wallets, they’re considered ‘hot’ wallets, and similar security precautions should be followed.

4. Online Wallets

Online wallets are hot wallets that are always connected to the internet. They are convenient and user-friendly, allowing access from multiple devices and making them suitable for everyday use. However, they are also more susceptible to cyber-attacks, hacking, and phishing attempts. Some online wallets also double as exchanges, making trading and storing convenient.

Examples of online wallets include:

- MyEtherWallet

- Electrum

5. Paper Wallets

Paper wallets are a form of ‘cold’ wallet, meaning they are entirely offline and thus safe from online hacking attempts. When you generate a paper wallet, your public and private keys are printed on a piece of paper.

You can then send funds to the public key’s address, and when you want to spend or transfer those funds, you’d import (sweep) the private key into a ‘hot’ wallet. The downside of paper wallets is that they are susceptible to physical damage (fire, water) and loss. Therefore, they need to be stored securely, for example, in a safe or safety deposit box.

Best Security Practices to Prevent Stolen Private Keys

To prevent your private keys from being stolen, follow these best practices:

- Never Share Your Private Keys: Your private key is like the password to your bank account. You wouldn’t share this information with anyone, and the same applies to your private key.

- Use Wallets with High-Security Standards: Make use of wallets that have robust security measures in place, like hardware wallets.

- Use Two-Factor Authentication: This requires not only a password and username but also something that only that user has on them, i.e., a piece of information only they should know or have immediately to hand.

- Regularly Update Your Wallet Software: Keeping your wallet software up to date ensures that you have the latest security enhancements available.

- Be Cautious of Phishing Attacks: Be cautious when clicking on links sent via email or social media. Always double-check the URL to ensure the site is secure (https).

- Keep A Backup: Always keep a backup of your wallet in another location. This helps you recover your wallet if it’s lost or your device is damaged.

- Regularly Check Your Devices for Malware: Regularly checking your devices for malware is another good practice. A compromised device can lead to a compromised wallet.

- Cold Storage: Consider using cold storage for a substantial amount of your cryptocurrencies. Cold storage involves keeping a reserve of cryptos offline. This protects them from possible theft in case an online wallet is compromised.

Also Read this Blog: Beginner’s Guide: Top Crypto Trading Apps and Best Crypto Exchange Sites 2023

Conclusion: Store Cryptocurrency Safely

Navigating the complex world of cryptocurrencies can seem daunting, particularly when it comes to keeping your digital assets secure. However, by understanding the concept of cryptocurrency wallets and different types of them, you are already ahead of many.

While the digital landscape is evolving at a lightning-fast pace, the fundamentals of securing your digital assets remain constant. Whether it’s hardware, mobile, desktop, online, or paper wallets, each has its strengths and potential weaknesses. Assessing your individual needs, usage patterns, and risk tolerance can guide you in selecting the most suitable wallet.

Remember, in the world of cryptocurrencies, you are your own bank, and with that comes the responsibility of implementing the best practices for ensuring your crypto’s safety. By staying informed and taking the right precautions, you can securely explore and enjoy the potential benefits that the world of cryptocurrency has to offer.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether