Table of Contents

Top Key Insights into Decentralized Finance (DeFi): The Future of Finance

Introduction

What if you could take control of your finances without the need for banks or traditional financial institutions? What if there was a system that was transparent, globally accessible, and not controlled by a central authority?

Welcome to the world of Decentralized Finance, or DeFi. In this post, we will delve into the revolutionary world of DeFi, explaining what it is, why it’s important, and how it’s changing the financial landscape.

What is Decentralized Finance (DeFi)?

Read Also: Crypto Trading For Beginners: A Comprehensive Guide

Read Also: How Many Crypto Wallets Should I Have

Decentralized Finance, commonly known as DeFi, is a disruptive innovation that uses blockchain technology and cryptocurrencies to eliminate the need for intermediaries in financial transactions.

It’s an open and global financial system built for the internet age, offering an alternative to traditional systems that are often opaque, tightly controlled, and reliant on outdated infrastructure.

Why is DeFi Relevant?

DeFi is not just a buzzword; it’s a fundamental shift in the way we manage and interact with money. It gives you control and visibility over your money, providing exposure to global markets and alternatives to your local currency or banking options. It’s a financial system where transactions are governed by smart contracts, not banks or governments.

The History of DeFi

The concept of DeFi took root with the advent of Bitcoin in 2009, which demonstrated that financial transactions could be conducted in a trustless, decentralized manner. However, it was the development of Ethereum, with its smart contract functionality, that truly laid the groundwork for the DeFi ecosystem we see today.

Ethereum’s smart contracts are self-executing contracts with the terms of the agreement directly written into code. This innovation opened the door for the development of complex decentralized applications (dApps), including those used for financial services.

The term “DeFi” was coined around 2018, as numerous projects began to emerge that leveraged blockchain technology to recreate traditional financial instruments in a decentralized manner, outside the purview of central authorities.

The Pros and Cons of DeFi

Like any technology, DeFi comes with its own set of advantages and challenges.

Pros

Accessibility: DeFi opens up financial services to anyone with an internet connection. This is particularly significant for unbanked or underbanked populations who may not have access to traditional banking services.

Transparency: All transactions on the blockchain are public, which means the operations of a DeFi protocol can be audited and verified.

Control over finances: DeFi gives individuals full control over their assets. There’s no need for a middleman or third party to approve transactions.

Cons

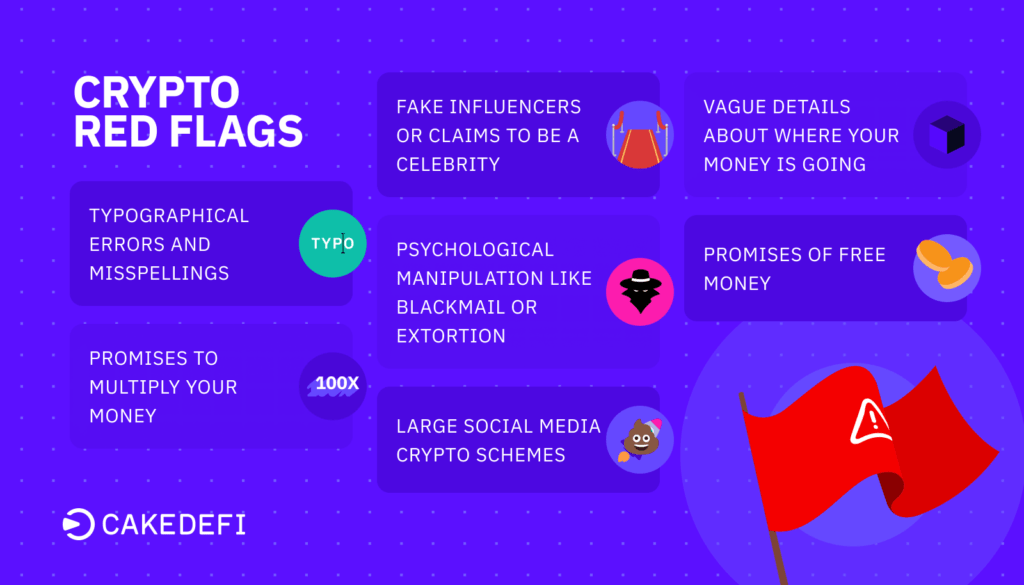

Smart contract risk: Smart contracts are still relatively new and bugs or vulnerabilities in the code can lead to significant losses.

Complexity: DeFi can be complex and hard to understand for the average user, creating a barrier to entry.

Regulatory uncertainty: The regulatory landscape for DeFi is still unclear, which can pose risks for users and projects in the space.

Key Components of DeFi

DeFi is made up of several key components, each playing a crucial role in the ecosystem.

Stablecoins: These are cryptocurrencies pegged to a stable asset, like the US dollar. They are often used in DeFi to reduce volatility.

Exchanges: Decentralized exchanges (DEXs) allow for direct peer-to-peer trading of cryptocurrencies.

Lending Platforms: These platforms use smart contracts to replace intermediaries such as banks that manage lending in the traditional financial world.

Derivatives: These are financial contracts that derive their value from an underlying asset. In DeFi, these can be created and settled on-chain.

Want to learn more about DeFi and how it can change your financial future? Subscribe to our newsletter for the latest insights and updates in the world of DeFi. Share this post with your friends and help them understand the power of decentralized finance.

In-Depth Look at Key Components of DeFi

Stablecoins

Stablecoins are a critical part of the DeFi ecosystem. They are cryptocurrencies designed to minimize volatility by being pegged to a reserve of stable assets, usually a fiat currency like the US dollar.

This stability makes them ideal for transactions and trading, as they don’t suffer from the same volatility as other cryptocurrencies like Bitcoin or Ethereum. Examples of popular stablecoins include Tether (USDT), USD Coin (USDC), and DAI.

Decentralized Exchanges (DEXs)

Decentralized exchanges, or DEXs, are platforms that allow for the peer-to-peer trading of cryptocurrencies. Unlike traditional exchanges, they operate without a central authority.

This means that trades occur directly between users, facilitated by smart contracts on the blockchain. Some of the most well-known DEXs include Uniswap, SushiSwap, and Curve Finance.

Lending Platforms

DeFi lending platforms are services that allow users to lend or borrow cryptocurrencies. They replace traditional intermediaries like banks with smart contracts.

Lenders can earn interest by providing liquidity to the platform, while borrowers can take out loans by providing crypto assets as collateral. Aave, Compound, and MakerDAO are among the most popular DeFi lending platforms.

Derivatives

In the context of DeFi, derivatives are financial contracts that derive their value from an underlying cryptocurrency asset. These can include futures, options, or swaps.

They allow users to hedge against potential price movements or speculate on price changes. Platforms like Synthetix and dYdX offer these services in the DeFi space.

Popular DeFi Platforms

Uniswap

Uniswap is a decentralized exchange protocol built on Ethereum. It uses an automated liquidity protocol. There are no order books. Instead, trades are executed directly against liquidity pools. These pools are filled by liquidity providers who deposit their assets into these pools and receive LP tokens in return.

Aave

Aave is a decentralized lending platform where users can lend and borrow a wide range of cryptocurrencies. Lenders earn interest by depositing digital assets into specially created liquidity pools. Borrowers can then use their crypto as collateral to take out a loan from these pools.

Compound

Compound is a DeFi lending protocol that allows users to earn interest on their cryptocurrencies by depositing them into one of several pools supported by the platform. Users can also borrow against their deposited tokens at a rate set by supply and demand.

MakerDAO

MakerDAO is a decentralized credit platform on Ethereum that supports DAI, a stablecoin whose value is pegged to USD. Users can open a vault, lock in collateral like ETH, and generate DAI as a debt against that collateral.

Decentralized Finance (DeFi) is a rapidly evolving field with the potential to reshape the global financial landscape. By leveraging blockchain technology and smart contracts, DeFi offers a transparent, accessible, and inclusive alternative to traditional financial systems. While it’s not without its challenges, the potential of DeFi to democratize finance is truly exciting.

The Impact of DeFi on the Financial Landscape

The advent of DeFi has significant implications for the financial landscape. It’s not just a technological innovation; it’s a shift in how we perceive and interact with financial systems.

Democratization of Finance

One of the most profound impacts of DeFi is the democratization of finance. Traditional financial systems are often exclusive, with barriers that prevent many people from accessing financial services.

DeFi, on the other hand, is open to anyone with an internet connection. This democratization can empower individuals, particularly in developing countries where access to financial services is limited.

Increased Financial Efficiency

DeFi can also lead to increased efficiency in financial transactions. Traditional financial systems often involve numerous intermediaries, each of which adds complexity and cost. DeFi, by contrast, leverages smart contracts to automate processes, reducing the need for intermediaries and increasing efficiency.

Innovation in Financial Products and Services

The DeFi ecosystem is a hotbed of innovation. Developers are continually creating new financial products and services that leverage the unique capabilities of blockchain technology.

These range from yield farming platforms to insurance protocols, expanding the range of financial services available to consumers.

Risks and Challenges in DeFi

While DeFi holds immense promise, it’s not without its risks and challenges. Understanding these is crucial for anyone looking to engage with the DeFi ecosystem.

Smart Contract Vulnerabilities

Smart contracts are at the heart of DeFi. However, they’re only as secure as the code they’re written in. Bugs or vulnerabilities in smart contract code can lead to hacks and the loss of user funds.

Therefore, it’s crucial for DeFi platforms to conduct thorough smart contract audits and for users to understand the risks involved.

Regulatory Uncertainty

The regulatory landscape for DeFi is still evolving. Many jurisdictions are yet to establish clear regulations for DeFi, leading to uncertainty that can deter some users and investors.

However, it’s worth noting that this is a common challenge for emerging technologies and that regulatory clarity is likely to improve as DeFi becomes more mainstream.

Scalability Issues

As with all blockchain-based systems, DeFi faces scalability issues. As the number of users grows, so does the strain on the network, leading to slower transaction times and higher fees.

Solutions like layer 2 scaling and sharding are being developed to address these issues, but they’re still in the early stages of deployment.

The Future of DeFi

Despite these challenges, the future of DeFi looks promising. With ongoing technological advancements and an increasing recognition of its potential, DeFi is poised to play a significant role in the future of finance.

As blockchain technology continues to evolve and mature, we can expect to see DeFi solutions becoming more robust, secure, and scalable.

Furthermore, as regulatory bodies around the world gain a better understanding of DeFi, we can anticipate more clarity in regulations, which will further boost confidence in DeFi.

Conclusion

Decentralized Finance (DeFi) is more than just a buzzword; it’s a revolutionary technology that’s reshaping the world of finance. By offering a transparent, accessible, and inclusive alternative to traditional financial systems, DeFi has the potential to democratize finance and empower individuals worldwide.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether