Table of Contents

Introduction to Crypto Trading For Beginners

In the realm of digital currencies, crypto trading is akin to the wild frontier – it’s a virtual landscape where bold pioneers can discover uncharted territory, where fortune can be made, but also lost. It’s a world where investors become explorers, charting the course of cryptocurrencies in a global market that operates 24/7.

Crypto trading, as the term suggests, involves the buying and selling of digital currencies in a bid to turn a profit. It’s a system that has grown in popularity alongside the rise of Bitcoin, Ethereum, and a myriad of other cryptocurrencies.

But what makes crypto trading so appealing? For starters, it’s an open market – anyone with an internet connection, a digital wallet, and some starting capital can join the ranks of crypto traders. Plus, it operates around the clock. Unlike traditional stock markets, which have fixed hours, the crypto market is open 24/7. This means opportunities – or sudden market shifts – can arise at any time.

Understanding Crypto Trading For Beginners

Before we delve further into the world of crypto trading, it’s important to understand what cryptocurrency is. In essence, cryptocurrency is a type of digital or virtual currency that uses cryptography for security. This makes it incredibly difficult to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an unknown person (or group of people) using the name Satoshi Nakamoto. Since then, over 4000 cryptocurrencies (often referred to as ‘altcoins’, i.e., alternatives to Bitcoin) have been created, including popular ones like Ethereum, Ripple, and Litecoin.

Cryptocurrencies work using a technology called the blockchain. Blockchain is a decentralized technology spread across many computers that manage and record transactions. The appeal of this technology is its security. By distributing data across a network, the blockchain makes it difficult for hackers to manipulate the data, making cryptocurrencies secure and resistant to fraud.

What is Crypto Trading?

Just like traditional stock trading, crypto trading involves buying and selling digital assets with the intention to generate profit. However, crypto trading is unique in several ways. Firstly, the cryptocurrency market is extremely volatile, meaning prices can change rapidly in very short periods. This volatility can present a higher risk, but also offers increased potential for high returns.

Secondly, crypto trading can happen 24/7. Unlike traditional markets like the New York Stock Exchange or the London Stock Exchange, which have specific trading hours, crypto markets are always open. This means that traders can trade at any time of the day or night, allowing for more flexibility.

Crypto trading also offers a wide variety of options for traders. You can choose to “HODL” (Hold On for Dear Life), which means buying a cryptocurrency and holding it for a long term, hoping its price will significantly increase over time. Alternatively, you can engage in day trading, where you aim to profit from short-term price movements by making many trades within a single day.

In the next sections, we will dive deeper into how to get started with crypto trading, the different types of crypto trading, and tools and strategies that can help you succeed in this volatile but potentially lucrative market.

Getting Started in Crypto Trading

Just like any other journey, the crypto trading voyage begins with a single step – setting up your crypto wallet and choosing a reliable exchange platform. However, getting into crypto trading also means doing some homework – understanding market trends, learning how to analyze price movements, and getting a grasp on trading terminologies. Let’s start with the basics:

Setting up Your First Crypto Wallet

Your crypto wallet is the digital equivalent of your regular wallet, except it doesn’t store physical currency – it holds your cryptocurrencies. Essentially, it is a software application that allows you to send, receive, and securely store your crypto assets.

There are several types of crypto wallets:

- Software Wallets – These can be installed on your personal computer or mobile device. They provide convenient access to your cryptocurrencies but are dependent on the security of your personal device.

- Online Wallets – These wallets are web-based and can be accessed from any device with an internet connection. They are convenient but are also susceptible to online threats.

- Hardware Wallets – These are physical devices, similar to USB drives, that store your cryptocurrencies offline. They offer the highest security but may not be as convenient as other types of wallets.

- Paper Wallets – These are physical printouts of your public and private keys. They can provide high security if stored properly but may be less convenient for regular use.

Choosing the right crypto wallet depends on your trading needs. If you plan on trading frequently, a software or online wallet may be more suitable. If you’re considering long-term investment, a hardware or paper wallet might be a better choice.

The crypto exchange is where the actual trading happens. It’s a platform that facilitates the buying and selling of cryptocurrencies. There are hundreds of crypto exchanges available today, each offering different features, fees, security measures, and supported cryptocurrencies.

Choosing a Reliable Crypto Exchange

When choosing a crypto exchange, consider the following factors:

- Security – Look for platforms that employ robust security measures, like two-factor authentication (2FA), withdrawal whitelist, and cold storage for funds.

- Supported Cryptocurrencies – Ensure the exchange supports the cryptocurrencies you wish to trade.

- Fees – Exchanges charge fees for deposits, trades, and withdrawals. Compare fee structures to find a platform that offers a good balance between cost and functionality.

- User Experience – A user-friendly interface can make trading more efficient, especially for beginners.

- Customer Support – Reliable customer service can be crucial when you encounter issues during trading.

Popular exchanges include Binance, Coinbase, Kraken, and Bitstamp. Each platform has its strengths and weaknesses, so it’s important to do your research to find an exchange that suits your needs.

In the next section, we’ll explore the different types of crypto trading and their unique characteristics. Stay tuned!

Types of Crypto Trading

Once you’ve got your wallet and exchange ready, it’s time to delve into the various types of crypto trading. The crypto market, much like the traditional financial market, offers a wide array of trading styles, each catering to different investment goals, risk tolerance, and time commitments.

Overview of Day Trading

Day trading is a type of short-term trading where you open and close positions within a single trading day. This style is heavily reliant on technical analysis and short-term price movements.

Pros:

- Potentially profitable due to the volatile nature of the crypto market.

- No overnight risk as positions are closed by the end of the day.

Cons:

- Requires significant time commitment and continuous market monitoring.

- High stress and requires swift decision-making skills.

Swing Trading Explained

Swing trading involves holding positions over a period of days to weeks, aiming to profit from price swings. It is a medium-term strategy that blends aspects of both day trading and long-term investing.

Pros:

- Less time-intensive compared to day trading.

- Allows for more detailed analysis and more calculated decision-making.

Cons:

- Requires patience and a good understanding of market trends.

- Overnight risks due to market volatility.

Understanding Scalping in Crypto Trading

Scalping is a hyperactive trading style that involves placing numerous trades throughout the day, aiming to profit from small price fluctuations. Scalpers often leverage high trading volumes for minimal per-trade profits.

Pros:

- Opportunities for profit are frequent due to the high number of trades.

- Limited exposure to long-term market volatility.

Cons:

- Extremely time-intensive and requires constant monitoring of the markets.

- High transaction costs due to the high number of trades.

Futures Trading in Cryptocurrency

Crypto futures trading allows traders to buy or sell a cryptocurrency at a predetermined price at a specific future date. This type of trading can be used for hedging current positions or speculating on price movements.

Pros:

- Allows traders to hedge against potential price fluctuations.

- Provides the opportunity to trade with leverage.

Cons:

- High risk, particularly for inexperienced traders, due to leverage.

- Possible losses can exceed your initial investment.

Margin Trading and its Risks

Margin trading involves borrowing funds to increase your trading position beyond what your existing capital allows. This type of trading amplifies potential profits but also potential losses.

Pros:

- Provides the opportunity to amplify profits.

- Allows for greater diversification.

Cons:

- High risk due to the possibility of losing more than your initial investment.

- Requires a high level of market understanding and risk management.

Now that we’ve looked at the different types of crypto trading, let’s move on to some of the tools and platforms that can facilitate your trading journey.

Crypto Trading Tools and Platforms

Being equipped with the right tools can make all the difference in your crypto trading journey. These tools can assist you in making informed decisions by providing useful market data, automating certain processes, and helping you keep track of your investments.

Choosing the Right Trading Platform

The trading platform you choose can directly impact your trading experience. It’s the interface you’ll be using to monitor the markets, place trades, and manage your account. A well-designed platform should be intuitive, reliable, and packed with useful features like charting tools, real-time price feeds, and a wide variety of supported cryptocurrencies.

Consider the following when choosing a trading platform:

- Reliability: A platform should have minimal downtime and fast execution speeds.

- Tools and Features: Look for platforms that offer comprehensive charting tools, live market feeds, and customizable interfaces.

- Security: Ensure the platform has strong security measures such as 2FA and encryption.

- Fees: Be aware of any trading fees associated with the platform.

How to Use Trading Bots

Trading bots are software programs that can execute trades on your behalf based on predetermined parameters. They can monitor market trends, place orders, and even execute trades 24/7. Here’s how to use them:

- Choose the Right Bot: There are several trading bots available, each with different features. Some bots are ideal for beginners, while others have features that are more suited for experienced traders.

- Set Your Parameters: Configure your bot according to your trading strategy. You can set parameters such as the cryptocurrencies to trade, the amount to trade, the price to buy/sell at, and more.

- Monitor Your Bot: Keep an eye on your bot’s performance and make adjustments as necessary.

Please note that while trading bots can help automate your trades, they should not replace your trading strategy and judgment. It’s important to monitor their performance and adjust your settings regularly.

Leveraging Mobile Apps for Crypto Trading

In today’s digital age, trading has gone mobile. There are countless apps available that allow you to trade cryptocurrencies right from your smartphone. These apps offer convenience and accessibility, allowing you to trade anytime, anywhere.

Look for apps that offer robust security features, real-time price updates, customizable alerts, and the ability to manage your account and place trades seamlessly.

Popular Trading Software

There are several popular trading software programs that crypto traders use to analyze market trends, develop strategies, and execute trades. These include:

- TradingView: Known for its robust charting features and social networking for traders.

- MetaTrader: Popular for its advanced technical analysis tools and automated trading features.

- Coinigy: A cloud-based platform that provides comprehensive tools for managing multiple exchange accounts in one place.

Each of these platforms has its own strengths and features, so choose the one that best fits your trading needs and style.

After understanding the types of crypto trading and getting familiar with the tools, it’s time to understand how to read and interpret crypto trading charts. This skill is vital in making informed trading decisions. So, let’s get to it!

Reading and Understanding Crypto Trading Charts

Trading charts are visual representations of price movements over a given period. They provide crucial information that can help you analyze the performance of a particular cryptocurrency and make more informed trading decisions.

Introduction to Candlestick Charts

Candlestick charts are among the most popular types of trading charts. They originated in Japan over 100 years ago and have been adopted by the global trading community due to the vast amount of information they provide.

A single candlestick represents a specific timeframe and contains four key pieces of information: the opening price, the closing price, the highest price, and the lowest price within that timeframe.

The main body (or the “real body”) of the candlestick represents the range between the opening and closing prices. If the closing price is higher than the opening price, the candlestick is usually filled (or colored in), indicating a bullish market. If the closing price is lower than the opening price, the candlestick is usually empty (or a different color), indicating a bearish market.

The thin lines protruding from the top and bottom of the real body are known as “shadows” or “wicks.” They represent the highest and lowest prices during the selected timeframe.

How to Read Line and Bar Charts

Line charts are the simplest form of trading charts. They plot the closing price of a cryptocurrency over a specified period, connecting each point to form a continuous line. This type of chart is useful for quickly identifying general price trends, but they lack the detailed information provided by candlestick charts.

Bar charts, also known as OHLC (Open, High, Low, Close) charts, provide more detail than line charts. Each “bar” represents a specific time period and shows the opening price (the horizontal line on the left), the closing price (the horizontal line on the right), and the highest and lowest prices (the vertical line).

Understanding Trading Indicators and Patterns

Trading indicators are mathematical calculations that traders use to predict future price movements. They can help identify trends, signal potential entry and exit points, and provide insight into the market’s momentum. Common indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands.

Trading patterns are specific formations created by price movements on the trading chart. These patterns can signal potential price movements and are often used in conjunction with trading indicators to confirm trading signals. Examples of trading patterns include head and shoulders, double top/bottom, and triangle patterns.

With a solid understanding of trading charts, you’re now ready to delve into crypto trading strategies. Let’s discuss how to formulate a strategy that aligns with your trading goals and risk tolerance.

Crypto Trading Strategies

The backbone of successful crypto trading is a solid trading strategy. A strategy is a predefined set of rules for making trading decisions. Traders develop strategies through comprehensive analysis and typically test them with historical data before putting real money on the line.

Fundamental Analysis in Crypto Trading

Fundamental analysis involves assessing the intrinsic value of a cryptocurrency. This means looking at everything from the technology behind the currency, the team running the project, to the wider economic and market factors affecting its price.

Key aspects to consider might include the utility of the cryptocurrency: what problem does it solve, or what need does it meet? Is there a clear roadmap for the project’s future, and is the team transparent about their progress? And don’t forget to assess the broader market trends: are cryptocurrencies gaining wider acceptance, or are regulatory pressures increasing?

For instance, if a crypto project is about to release a major upgrade or feature, it might increase the token’s demand, leading to a price increase.

Technical Analysis: A Detailed Look

In contrast to fundamental analysis, technical analysis is not concerned with a cryptocurrency’s intrinsic value. Instead, it involves statistical analysis of historical market activity, such as price and volume.

Traders use various indicators to identify patterns that can suggest future activity. As discussed earlier, common technical analysis tools include moving averages, RSI, and Bollinger Bands.

Remember, no technical analysis tool provides a 100% guarantee of predicting market movements. It’s crucial to combine tools and keep a pulse on market news.

Risk Management in Crypto Trading

Risk management is arguably the most crucial element of your trading strategy. No matter how skilled you are at reading charts and predicting market movements, losses are inevitable.

Risk management strategies include setting stop-loss orders to limit potential losses, diversifying your portfolio to spread risk, and never investing more than you can afford to lose.

Position Sizing: An Essential Strategy

Position sizing is the part of your trading strategy that defines how much of your capital you should invest in a single trade. This strategy helps protect your portfolio from being significantly affected by a single trade.

One popular position sizing strategy is the “1% risk rule,” which suggests never risking more than 1% of your trading capital on a single trade. This means if you have a trading capital of $10,000, you should never risk more than $100 on a single trade.

With these strategies in hand, it’s important to remember that trading involves more than just analysis and strategy. It also involves understanding the regulations and taxation surrounding crypto trading, as well as mastering your trading psychology. Let’s delve into these topics next.

Regulation and Taxation in Crypto Trading

Before you start trading, it’s crucial to be aware of the regulations and tax implications surrounding crypto trading. Compliance with these rules not only keeps your trading activities legal but can also save you from unnecessary headaches in the future.

Understanding Crypto Regulation

Cryptocurrency regulation varies greatly around the world, with some countries embracing the technology more openly than others. It’s essential to understand the regulations in your country before you start trading.

Some of the key regulatory aspects to consider include whether cryptocurrency is considered legal tender, whether it’s legal to trade it, and what kind of licensing is required for exchanges or other businesses dealing with cryptocurrency.

Governments are still grappling with how to regulate the rapidly evolving crypto sector. Therefore, it’s also important to stay up-to-date with any regulatory changes in your country that could affect your trading activities.

Tax Implications for Crypto Traders

Taxation is another critical consideration for crypto traders. In many jurisdictions, cryptocurrency is considered a taxable asset, and failing to report your earnings could lead to penalties.

For instance, in the US, the Internal Revenue Service (IRS) treats cryptocurrencies as property, and any transaction using digital currency is considered a taxable event. This means you could owe capital gains tax on any profits made from your trading activities.

Each country has its own rules when it comes to taxing cryptocurrency. It’s important to consult with a tax professional to understand your obligations and ensure you’re keeping accurate records of your trading activities.

Trading successfully isn’t just about analysis, strategy, and understanding regulations. It’s also about having the right mindset, which we will discuss next.

Psychology of Trading

Even the best strategies can fail if a trader can’t control their emotions. Fear, greed, impatience, and a lack of discipline can all lead to poor trading decisions and potential losses.

Handling Fear and Greed in Trading

Fear and greed are two emotions that can have a significant impact on your trading decisions.

Fear can lead to panic selling, causing you to sell your cryptocurrency even when holding might be a better decision. On the other hand, greed can lead to overconfidence, tempting you to risk more than you can afford in the hope of bigger gains.

Both emotions can be managed by sticking to your trading strategy, using stop losses and take profits, and never investing more than you can afford to lose.

Importance of Patience and Discipline

Patience and discipline are vital skills for crypto trading. Markets move in cycles, and waiting for the right moment to enter or exit a trade can be the difference between profit and loss.

Sticking to your trading plan, even when things aren’t going your way, is crucial. It’s easy to let emotions take over when a trade goes against you, but staying disciplined can help you stick to your strategy and avoid making rash decisions.

Next, we’ll share some useful tips and tricks to help you navigate the crypto trading landscape.

Tips and Tricks for Successful Crypto Trading

Now that you’ve understood the basics of crypto trading, let’s dive into some tips and tricks that can help you on your trading journey. Successful trading is not just about understanding the markets, but it’s also about developing good habits, setting goals, and being consistent.

Setting Goals for Trading

Setting clear and achievable goals is crucial for your trading journey. Goals provide direction and make it easier to measure progress. Start by setting short-term goals such as learning how to read a chart, understanding different trading indicators, or making your first successful trade.

Over time, you can set more ambitious goals such as increasing your portfolio size, achieving a certain percentage of profits, or mastering a new trading strategy.

Remember, it’s important to set realistic goals that match your risk tolerance and experience level. Trading is a marathon, not a sprint, so focus on gradual progress rather than overnight success.

Why Consistency is Key

Consistency is a key trait of successful traders. This means sticking to your trading plan, even when things don’t go as expected. It also means keeping your emotions in check and not making impulsive decisions based on market fluctuations.

Consistent traders understand that not every trade will be profitable, and they don’t let a losing trade derail their strategy. Instead, they analyze their losses, learn from their mistakes, and use this knowledge to improve their future trades.

The Importance of Keeping a Trading Journal

Keeping a trading journal is an invaluable tool for any trader. A journal helps you track your trades, strategies, and thoughts, giving you an objective record of your trading journey.

Record every trade you make, including the date, the price, the size of the trade, the reason for the trade, and the outcome. This will help you identify patterns, learn from your mistakes, and make more informed trading decisions in the future.

After setting your goals and understanding the importance of consistency and journaling, you’re well-equipped to navigate the crypto trading world. But it’s also crucial to understand the risks and learn how to stay safe while trading.

Avoiding Crypto Trading Scams

As the popularity of cryptocurrencies continues to grow, so too does the number of scams targeting unsuspecting traders. Here’s how to stay safe while trading.

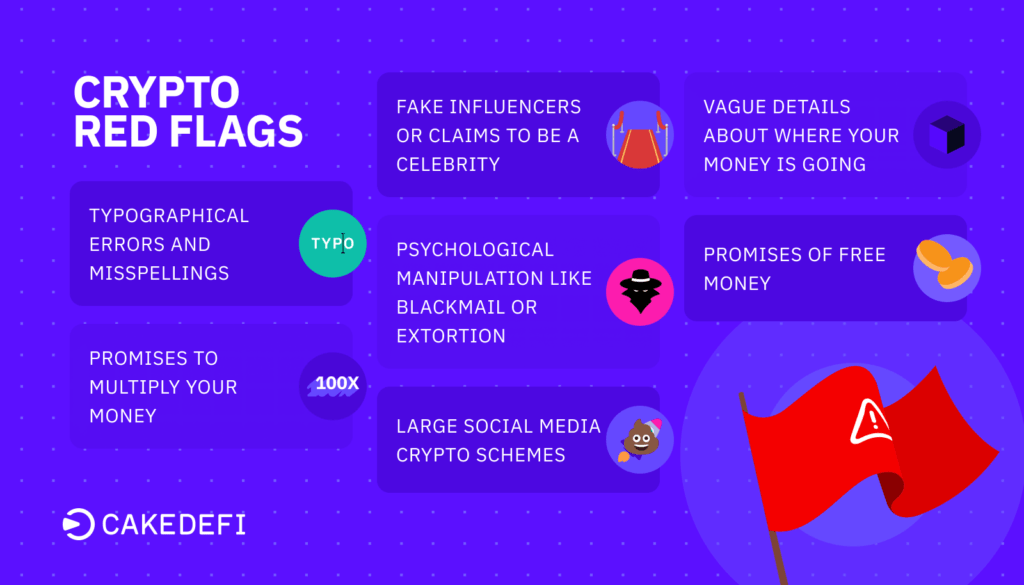

Spotting Common Crypto Scams

Crypto scams come in many forms, from phishing attempts to fake exchanges and fraudulent initial coin offerings (ICOs).

Phishing scams involve scammers trying to trick you into providing sensitive information, such as your wallet’s private keys or login information for your exchange account. Always double-check the source of any communication and never share your private keys with anyone.

Fake exchanges and wallets can mimic legitimate ones, tricking you into depositing your crypto into a scammer’s account. Be sure to research any platform thoroughly before making a deposit. Look for reviews, check their security measures, and use platforms that are well-known and trusted within the community.

How to Stay Safe While Trading

Here are a few practical tips to help you stay safe while trading:

- Use a hardware wallet or a secure offline storage method for your cryptocurrencies.

- Enable two-factor authentication on all of your accounts.

- Be wary of too-good-to-be-true promises. If something sounds too good to be true, it probably is.

- Always research and verify information before making any investments.

Finally, let’s look at the future of crypto trading, where it’s headed, and how you can stay ahead of the curve.

Conclusion: The Future of Crypto Trading

The Evolution of Crypto Trading

Crypto trading has come a long way since the launch of Bitcoin in 2009. From just one cryptocurrency, we now have thousands, each with its own unique features and use cases. Trading platforms have evolved too, offering more tools, features, and security measures than ever before.

We’ve also seen the emergence of decentralized exchanges (DEXs) that allow peer-to-peer trading without the need for an intermediary. DEXs have the potential to revolutionize the way we trade cryptocurrencies, offering increased privacy and reduced reliance on centralized entities.

Emerging Trends in Crypto Trading

As we look towards the future, several exciting trends are set to shape the next phase of crypto trading.

- Decentralized Finance (DeFi): DeFi applications aim to recreate traditional financial systems with cryptocurrency, and they’re gaining momentum. Platforms that enable you to lend, borrow, trade, earn interest, and more, all in a decentralized way, are flourishing. Traders are looking to these platforms as a way to trade without the need for intermediaries.

- Central Bank Digital Currencies (CBDCs): More and more central banks are exploring the idea of issuing their digital currencies. The introduction of CBDCs will not only validate the concept of digital money but also introduce a whole new asset class to trade.

- Technological advancements: Technology in the crypto space is always improving. The future will undoubtedly bring more sophisticated trading bots, more advanced and secure exchanges, and new trading instruments. This will make trading even more accessible and profitable, opening up the space to more participants.

- Regulation: As the crypto space grows, so does the attention from regulators. While some may see this as a negative, clear regulations can lead to more stability and trust in the market. Traders will have a clearer understanding of their obligations and rights, and more safeguards will be in place to protect them.

Crypto trading is no longer a niche market; it’s an industry that’s growing at an exponential rate. The increased adoption of cryptocurrencies and blockchain technology worldwide guarantees a vibrant and exciting future for crypto trading.

One of the most significant trends in crypto trading is the rise of DeFi, or decentralized finance. DeFi platforms use smart contracts to automate financial transactions, creating a decentralized financial system that operates without intermediaries.

Other emerging trends include the increasing use of artificial intelligence (AI) in trading, the rise of social trading platforms where traders can share and follow each other’s strategies, and the growth of mobile trading, which allows traders to manage their portfolios on the go.

So, there you have it: a comprehensive guide to getting started with crypto trading. Remember, trading is a journey of continuous learning. Stay informed, stay safe, and happy trading!

FAQs

- What is the best time to trade cryptocurrency? Unlike traditional markets that operate during specific hours, the crypto market operates 24/7. This means you can trade at any time that suits you. However, it’s essential to note that trading volumes can vary depending on the time, which may impact the liquidity and volatility of certain cryptocurrencies.

- Can I make a living trading cryptocurrency? While it’s possible to make a living trading cryptocurrency, it’s not guaranteed. Like any form of trading, it involves risk, and the volatile nature of the crypto market means profits can quickly turn into losses. It’s crucial to have a solid understanding of crypto trading, a clear strategy, and a willingness to continuously learn and adapt.

- What is slippage in crypto trading? Slippage occurs when the price at which your trade is executed differs from the price you expected. This typically happens in volatile markets or when a large order moves the market price before it can be fully filled. To minimize slippage, traders often use limit orders, which only execute the trade at the specified price or better.

- What is a stop loss in crypto trading? A stop loss is a type of order that closes a trade once the price of the cryptocurrency falls to a certain level. It’s a tool used by traders to limit their potential losses if the market moves against them.

- What is a bull market and a bear market in crypto trading? A bull market refers to a market condition where prices are rising or are expected to rise. In contrast, a bear market represents a condition where prices are falling or are expected to fall. These terms are derived from the way these animals attack their opponents—a bull thrusts its horns up into the air, while a bear swipes its paws downward.

- What’s the difference between spot trading and futures trading in cryptocurrency? In spot trading, you buy or sell a cryptocurrency and the transaction is settled “on the spot,” meaning the ownership of the cryptocurrency changes hands immediately. On the other hand, in futures trading, you’re agreeing to buy or sell a certain amount of cryptocurrency at a future date and at a predetermined price.

- How can I manage risk in crypto trading? There are several ways to manage risk in crypto trading. These include setting a stop loss to limit potential losses, diversifying your portfolio, only investing what you can afford to lose, and continuously educating yourself about the market.

- Is crypto trading legal? The legality of crypto trading varies by country. Some countries fully embrace it, some have limitations, while others have outright banned it. It’s important to research the regulations in your country before you start trading.

- Can I day trade crypto? Yes, day trading is a common trading strategy in the crypto market due to its 24/7 operation. However, it requires a deep understanding of the market and the ability to monitor price movements closely.

- What’s the difference between a market order and a limit order? A market order is an order to buy or sell a cryptocurrency immediately at the best available price. A limit order, on the other hand, is an order to buy or sell a cryptocurrency at a specific price, or better. With a limit order, the trade will only execute if the market price reaches your specified price.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  USDC

USDC  Lido Staked Ether

Lido Staked Ether