So, what is volatility in crypto? Welcome to our comprehensive guide on understanding volatility in cryptocurrency markets. If you’ve ever wondered why crypto prices can skyrocket or plummet in a matter of hours, you’re not alone.

In this article, we’ll demystify the concept of volatility and delve into the factors that contribute to price fluctuations in the crypto market.

Whether you’re a seasoned trader or a curious investor, this guide will equip you with the knowledge to navigate the exciting, yet unpredictable, world of crypto volatility.

Volatility refers to the degree of price fluctuation in the cryptocurrency market. It measures the rate at which the price of a particular cryptocurrency rises or falls within a given period.

Unlike traditional financial markets, crypto markets are known for their high levels of volatility, which can present both opportunities and risks for investors.

Cryptocurrencies like Bitcoin, Ethereum, and others can experience substantial price swings within a single day, with percentage changes that would be considered extraordinary in more established markets.

This inherent volatility is influenced by various factors, which we will explore in the following sections.

Why Does Volatility Occur in the Crypto Market?

Market Liquidity:

Lack of liquidity is a major contributor to volatility in the crypto market. Unlike traditional assets such as stocks or bonds, cryptocurrencies are still relatively young and have lower trading volumes. Consequently, even relatively small buy or sell orders can have a significant impact on prices, leading to sudden price movements.

Speculation and Emotional Factors:

Speculation plays a substantial role in crypto markets, often driven by investor sentiment and market psychology. FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt) can lead to sudden buying or selling sprees, causing prices to surge or crash rapidly.

Regulatory Developments:

Government regulations and policy announcements can heavily influence cryptocurrency prices. News of potential regulations or bans on crypto in certain jurisdictions can create panic and result in price volatility.

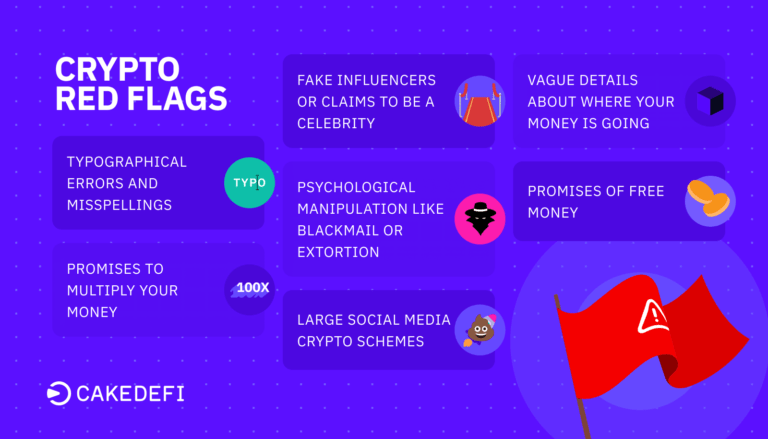

Market Manipulation:

The crypto market is also vulnerable to manipulation by whales and large market participants who can artificially inflate or deflate prices. Such manipulative practices, such as pump-and-dump schemes, contribute to short-term price volatility.

Impact of Volatility on Crypto Investors:

Profit Opportunities:

While volatility can be nerve-wracking, it also presents opportunities for savvy traders to profit. By accurately predicting short-term price movements, traders can execute timely buy and sell orders to capitalize on price fluctuations.

Risk Management:

Volatility, on the other hand, poses risks to investors. Sudden price drops

can lead to significant losses if investments are not strategically managed. Risk mitigation strategies such as setting stop-loss orders and diversifying portfolios are essential in managing volatility-induced risks.

Psychological Impact:

Volatility can take a toll on the emotional well-being of investors. Rapid price swings and uncertainty can lead to stress, anxiety, and irrational decision-making. Maintaining a rational mindset and sticking to a well-defined investment plan are crucial during turbulent market conditions

Strategies for Dealing with Volatility:

Setting Realistic Expectations:

Understanding that volatility is an inherent characteristic of cryptocurrencies helps set realistic expectations. Crypto investors should expect price swings and be mentally prepared for market turbulence.

Diversification

:

Diversifying one’s crypto portfolio across different cryptocurrencies and asset classes can help mitigate the impact of volatility. Spreading investments can potentially offset losses incurred in one asset class with gains in another.

Stop-loss Orders:

Implementing stop-loss orders allows investors to automatically sell their assets if prices reach a predetermined level. This strategy helps limit potential losses and protects investments during periods of heightened volatility.

Cryptotechnical Analysis:

Utilizing technical analysis tools and indicators can assist investors in identifying patterns and trends in price movements. By analyzing historical data and chart patterns, investors can make more informed decisions based on market signals.

Case Studies: Historical Volatility Events:

Bitcoin’s Bull Run and Crash in 2017:

The unprecedented surge in Bitcoin’s price in late 2017, often referred to as the “crypto bubble,” was followed by a dramatic crash in early 2018. This extreme volatility served as a cautionary tale for investors and highlighted the need for risk management strategies.

The COVID-19 Pandemic and Crypto Market:

The global pandemic in 2020 introduced a new wave of volatility in the crypto market. While traditional financial markets plummeted, cryptocurrencies experienced a mix of rapid declines and subsequent recoveries, showcasing the resilience and volatility of the crypto space.

Future Outlook and Trends:

The future of crypto market volatility remains uncertain. However, as the industry matures, increased liquidity, regulatory clarity, and institutional involvement are expected to bring more stability to the market.

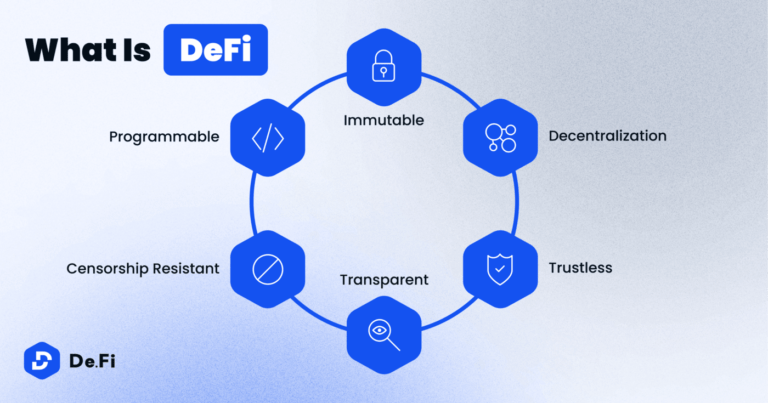

Additionally, the emergence of innovative risk management tools and decentralized finance (DeFi) protocols aims to address volatility-related concerns.

Volatility is an integral part of the cryptocurrency market, driven by various factors such as liquidity, speculation, regulations, and market manipulation. While it presents both opportunities and risks, understanding and managing volatility is crucial for crypto investors.

By adopting informed strategies, diversifying portfolios, and staying informed about market trends, investors can navigate the exciting yet unpredictable world of crypto volatility with confidence.

Remember, while volatility may initially seem daunting, it’s also what makes the crypto market an exciting and potentially rewarding space for investors. Stay informed, manage your risks, and embrace the opportunities that volatility brings.

Case Studies: Historical Volatility Events

Bitcoin’s Bull Run and Crash in 2017: One of the most notable examples of volatility in the crypto market is Bitcoin’s historic bull run in 2017. During this period, Bitcoin’s price skyrocketed, reaching an all-time high of nearly $20,000 in December.

However, shortly after reaching its peak, the price experienced a sharp decline, plunging by more than 80% in the following months.

This extreme volatility in Bitcoin’s price during 2017 demonstrated the potential for significant gains but also highlighted the risks associated with sudden price corrections.

It served as a wake-up call for many investors, emphasizing the importance of risk management and understanding the underlying dynamics of the crypto market.

The COVID-19 Pandemic and Crypto Market:

The global pandemic that unfolded in 2020 had a significant impact on the crypto market, leading to a mix of volatility and resilience. As traditional financial markets experienced a severe downturn, cryptocurrencies faced their own set of challenges.

During the initial stages of the pandemic, crypto prices experienced a sharp decline, mirroring the broader market sentiment.

However, as governments worldwide implemented fiscal stimulus measures, cryptocurrencies began to recover, attracting renewed interest from investors.

This period showcased the volatility inherent in the crypto market, as prices fluctuated in response to changing economic conditions, investor sentiment, and regulatory developments.

It reinforced the notion that cryptocurrencies, while decentralized and independent, are not immune to external factors and can exhibit volatility similar to other financial assets.

Future Outlook and Trends

The future of crypto market volatility remains uncertain, but there are several trends and developments worth considering:

- Increasing Liquidity: As the crypto market continues to mature, liquidity is expected to improve. Increased trading volumes and the entry of institutional investors are likely to reduce the impact of smaller buy or sell orders on prices, potentially leading to decreased volatility.

- Regulatory Clarity: Regulatory frameworks and guidelines specific to cryptocurrencies are gradually taking shape in various jurisdictions. Clarity in regulations can help mitigate uncertainty and reduce volatility by providing a more stable and predictable environment for investors and market participants.

- Institutional Involvement: The entry of institutional players, such as hedge funds, asset managers, and major corporations, into the crypto space is gaining momentum. Their participation can bring stability and liquidity to the market, potentially dampening volatility.

- Decentralized Finance (DeFi): The rise of decentralized finance protocols presents new opportunities and challenges. While DeFi introduces innovative ways to access financial services, it also introduces new forms of risk. The impact of DeFi on market volatility remains an area of ongoing exploration.

Conclusion: What is Volatility in Crypto?

Understanding volatility is crucial for anyone involved in the crypto market. It is a fundamental characteristic of this nascent industry, driven by factors such as market liquidity, speculation, regulations, and market manipulation.

While volatility can present both opportunities and risks, it’s essential to approach the market with a well-defined investment plan, realistic expectations, and risk management strategies.

By diversifying portfolios, setting stop-loss orders, and utilizing technical analysis, investors can navigate the challenges posed by volatility. Additionally, staying informed about market trends and learning from historical volatility events can provide valuable insights and guidance.

While volatility may initially appear daunting, it also presents opportunities for those willing to embrace the risks and uncertainties of the crypto market.

As the industry continues to evolve, with increasing liquidity, regulatory clarity, and institutional involvement, we can expect the crypto market to mature, potentially leading to more stability and reduced volatility over time.

Remember, investing in cryptocurrencies involves inherent risks, and it’s crucial to conduct thorough research, seek advice from reputable sources, and make informed decisions based on your individual circumstances and risk tolerance.

FAQ: Understanding Volatility in the Crypto Market

Q1: What is volatility, and why is it prevalent in the crypto market? A1: Volatility refers to the degree of price fluctuation in the crypto market. It is prevalent in the crypto market due to factors like market liquidity, speculation, regulatory developments, and market manipulation.

Q2: How does volatility affect crypto investors? A2: Volatility can present both opportunities and risks for crypto investors. It can offer profit opportunities through timely trading decisions. However, it also increases the risk of significant losses if investments are not strategically managed.

Q3: How can I manage the risks associated with crypto market volatility? A3: To manage volatility risks, consider diversifying your portfolio, setting realistic expectations, utilizing stop-loss orders, and conducting technical analysis. These strategies can help mitigate the impact of price fluctuations and protect your investments.

Q4: Can volatility in the crypto market be predicted or controlled? A4: While it is challenging to predict or control volatility with absolute certainty, analyzing market trends, conducting technical analysis, and staying informed about regulatory developments can help you make more informed decisions in response to market conditions.

Q5: How do institutional investors influence crypto market volatility? A5: Institutional investors can impact crypto market volatility through their large-scale trades and market participation. Their entry into the market can increase liquidity, provide stability, and potentially reduce volatility over time.

Q6: Are there any risk management tools specifically designed for dealing with crypto market volatility? A6: Yes, various risk management tools have emerged in the crypto space. These include options for setting stop-loss orders, utilizing hedging strategies, and using decentralized finance (DeFi) protocols to manage risks associated with lending and borrowing.

Q7: What are some historical events that highlight the impact of volatility in the crypto market? A7: Two notable historical events include Bitcoin’s bull run and subsequent crash in 2017, which demonstrated extreme volatility, and the COVID-19 pandemic’s impact on crypto prices, showcasing how global events can influence the crypto market.

Q8: Will crypto market volatility decrease as the industry matures? A8: While volatility may decrease as the crypto market matures, it is difficult to predict with certainty. Factors such as increased liquidity, regulatory clarity, and institutional involvement are expected to contribute to potential stability over time.

Q9: Can I use volatility to my advantage in the crypto market? A9: Yes, volatility can present profit opportunities for traders who can accurately predict short-term price movements. However, it requires careful analysis, risk management, and an understanding of market dynamics.

Q10: How can I stay informed about market trends and developments related to crypto market volatility? A10: To stay informed, follow reputable news sources, join crypto communities, and engage with industry experts. Stay up-to-date with market analysis, regulatory news, and technological advancements to make informed decisions.

Remember, while the answers provided here aim to offer general guidance, it’s essential to assess your individual circumstances and consult with financial professionals for personalized advice.

Feel free to adjust and modify these questions and answers based on your specific needs and the target audience of your blog post.

Read Also: how many cryptocurrency wallets should I have

References:

- Investopedia: Understanding Cryptocurrency Volatility

- CoinMarketCap: Crypto Market Capitalization and Liquidity

- Forbes: The Psychology Behind Cryptocurrency Investing

- Cryptoslate: Crypto Market Manipulation: How Whales Manipulate Prices

- Coindesk: Technical Analysis: A Beginner’s Guide

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether